Every few years, a strong competitor quietly appears on Amazon’s path. Ten years ago, it was eBay, Walmart, and Google in the United States. Now, it is the emerging forces from the East, China’s “Four Cross-Border eCommerce Tigers”, SHEIN, TikTok, Temu, and AliExpress.

Although Amazon has been sitting firmly on the throne of the global eCommerce industry for many years with its profound heritage, huge logistics network, and advanced technology. Now, under the seemingly calm sea, there are actually undercurrents.

Especially the emerging Temu, its business mode is more and more like Amazon, like a shadow opponent that constantly imitates and tries to surpass, forcing Amazon to face this cruel low-price storm. In order to defend its market share, Amazon launched the low-price mall Haul last November, adjusted the sails and returned to the original “Amazon”, trying to find a new balance and direction in this turbulent wave of price wars.

In 2024, we witnessed Amazon returning to its original intention under heavy pressure, and we also saw that “Low-price CBEC” was regulated worldwide. The era of mass merchant became a historical memory like a distant mirage.

However, China’s CBEC still showed tenacious vitality and amazing adaptability. The semi-hosted mode quickly broke out and became a new growth engine for many Chinese CBEC brands. At the same time, various unique cross-border new products continue to emerge and win the favor of global consumers. These positive changes have injected vigorous development vitality into the upcoming 2025.

Amazon & Temu: Becoming More “Alike”

Amazon cannot ignore the threat that Temu posed last year.

A series of detailed data are a powerful testimony to Temu’s rise. In August 2024, Temu’s global user base has risen strongly to 91% of Amazon’s. At this rate of development, it is expected that in 2025, this rising star is likely to surpass Amazon, an eCommerce giant with 30 years of deep foundation.

Data from October last year showed that in just two years, Temu has become the 2nd most visited eCommerce site in the world, a step behind Amazon. And in Amazon’s core market, the United States, Temu won the AppStore’s most-downloaded app in 2024.

From the perspective of consumers, the boundary between Amazon and Temu seems to be increasingly blurred. After the semi-hosted mode was launched in March, more than 60% of the most popular Chinese Amazon merchants joined Temu until October, and their followers can buy many of the same Amazon products on Temu, and the delivery time has also been shortened.

Faced with Temu’s fierce offensive, Amazon quickly made a strategic response. Referring to Temu’s low-price brandless mode, Amazon decisively launched the low-price mall Haul in November, accurately targeting the market for goods priced below $20. Haul also brought out the slogan “Say hello to crazy low prices”, as a head-on confrontation against Temu’s “Shop like a billionaire”.

Shortly after the launch of Haul, market news revealed that Temu was considering launching a 3rd-party platform mode. This strategic move can’t help but remind people of the key to Amazon’s successful transformation from self-operated to a platform. It was the introduction of merchants to settle in, realizing platform supply, greatly enriching the product categories on the platform, and thus opening up rapid growth. Today, Temu seems to be trying to replicate this successful path and further stir up the eCommerce market.

Recently, there have been rumors in the market that Amazon asked merchants to “choose one of the two” between Temu and Amazon, and the news instantly triggered heated discussions and widespread attention in the eCommerce realm. Regardless of rumors or not, the high attention Amazon has paid to Temu reflected behind this incident has become an undeniable fact.

Semi-Hosted: The Ultimate CBEC Solution

Although the full-hosted mode once occupied a place in the market, its limitations have gradually been exposed. Light and small items rely on the direct shipping of small packages, which saves the trouble of stocking, it also limits the room for the increase of the customer unit price of the goods and the richness of the categories. Therefore, the development ceiling of the full-hosted mode is limited.

In 2024, especially, air transport capacity has approached saturation, and the tax-free thresholds of various countries have continued to decrease. The changes in the market environment are urgently calling for the birth of a new mode. At this time, the semi-hosted mode has become the key solution to breaking through the puzzle of the “New Era of Cross-Border eCommerce”.

Through the semi-hosted mode, Temu, SHEIN, AliExpress, and TikTok have attracted a large number of Amazon sellers to join, and have achieved a significant leap in logistics efficiency by using the cross-border logistics system that Amazon sellers have already built, reducing the delivery time from 2 weeks to within 1 week. At the same time, the semi-hosted mode has also enriched the platform’s commodity supply, and the categories have been significantly expanded in all dimensions.

By the way, Temu even encourages merchants to ship directly with Amazon’s packages, hoping to leave users with the impression of “the same goods as Amazon, but at a lower price”.

The dividends brought by the semi-hosted mode are far more than the prosperity of the platform. For Amazon sellers, it is also a blessing. According to the financial report of SAILVAN TIMES, in the first half of 2024, their sales on the Temu platform reached ¥60.6 m (approx. $8.27 m), and Temu became their 3rd largest revenue platform. On the other side, AliExpress said that within 100 days of the launch of semi-hosted, 20,000 merchants doubled their orders by using this mode. This series of data fully proves the huge appeal and commercial value of the semi-hosted mode for CBEC merchants.

In order to further deepen the semi-hosted field, Temu’s semi-hosted mode will usher in three major adjustments at the organizational level. Each group of the investment promotion team will be finely divided according to the category, integrated with the buyer group, and uniformly included in the category operation system to improve operational efficiency and professionalism. At the same time, Temu is urgently investigating and training employees’ English skills to prepare for future overseas markets.

We can say, that in 2024, “Four CBEC Tigers” dominated the worldwide CBEC market by using the semi-hosted mode.

Of course, the innovative wind of semi-hosted is not limited to the realm of CBEC, and its influence has gradually spread to China’s domestic eCommerce platforms. Domestic eCommerce giants such as Taobao, Kuaishou, and Ele.me also followed suit. In March 2024, Kuaishou eCommerce launched a new semi-hosted service, “Kuaishou Selection”. Then the next month, Ele.me officially launched a semi-hosted service for merchants.

Crackdown on “Low-Price CBEC”: Capacity-Go-Overseas Accelerated

SHEIN, TikTok, Temu, and AliExpress quickly gained their positions in the global market with high-quality and low-priced goods. A large number of small-value imported goods flooded into the markets of overseas countries like a tide, bringing benefits to local consumers while also changing the traditional trade structure. Facing the rapid changes, overseas countries built trade barriers one after another, and a siege against “low-priced CBEC” has already been laid out.

Countries started the “encirclement and suppression” against China CBEC.

The duty-free quotas for small-value imported goods were repeatedly reduced, like a door that was gradually closing, blocking the influx of low-priced goods. At the same time, the tariff rate continued to rise, causing the cost of these small-value imported goods to rise sharply, and the previous price advantage was gradually exhausted, and room for “low-priced CBEC” to continue to develop was sharply compressed.

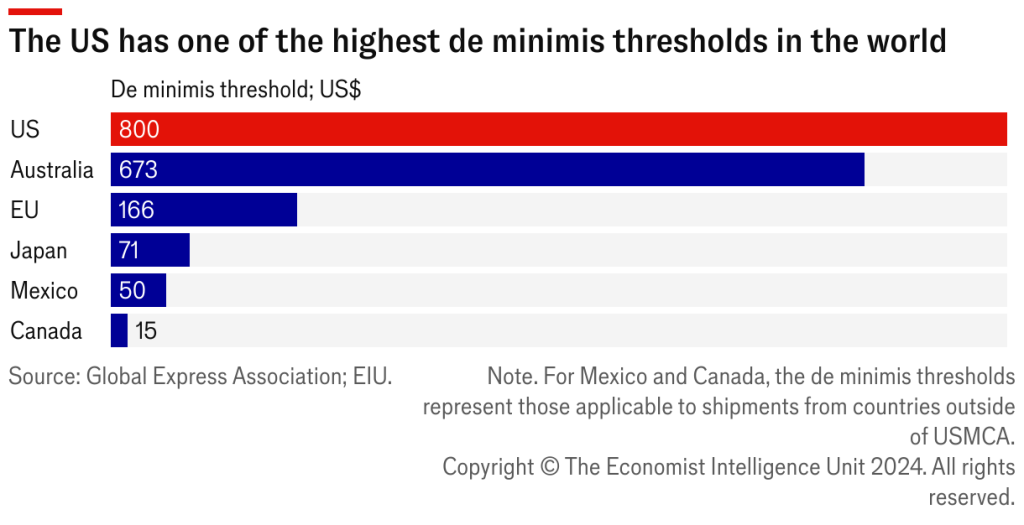

The U.S. Customs has tightened the T86 customs clearance policy and plans to adjust the duty-free mechanism for small packages of $800; Trump has also, over and over, proposed to increase tariffs on Chinese imports, including wood tariffs raised to 60%. Malaysia, Vietnam, Brazil and South Africa have also adjusted their policies and plan to impose corresponding value-added tax on goods.

Faced with such a severe cross-border trade situation, Chinese companies have begun to go to all parts of the world with advanced technology, mature production experience and sufficient funds, and the process of capacity-go-overseas has accelerated.

In Southeast Asia, Africa, Europe and America, Chinese companies can be seen setting up R&D centers and production bases. In addition, Chinese companies have also actively established close cooperation with local suppliers, studied local laws and regulations, cultural customs, and market preferences, continuously optimized product design and overseas marketing strategies, and gradually built a complete overseas production, sales, and service network.

In this way, Chinese companies have not only successfully avoided the risks brought by trade barriers, but also further enhanced their position and influence in the global industrial chain.

No More Mass Merchant: Rise of “Content” CBEC

In 2024, mass merchant CBEC mode was gradually coming to an end, and more and more brands and merchants are beginning to pay attention to the investment in content marketing.

“Mass Merchant” can be said to be a “shortcut to wealth” in the early stage of the CBEC. As time goes by, with the increasingly stringent platform rules and the growing consumer demand, transformation, change, and exploring go-overseas have become new development directions.

On the road of product innovation, the wave of AI is surging. From the initial imitation and learning to today’s independent innovation, Chinese brands can be said to have “counterattacked” foreign predecessors. In terms of kitchen appliances, intelligent small appliances have gradually become new favorites in European and American family kitchens.

At the operational level, content eCommerce is rising. Many Chinese domestic brands have long realized the importance of content and have formed professional content teams to shoot attractive product images, produce vivid and interesting product videos, and publish a large number of product review videos on social media. The emergence of Douyin or TikTok has opened the door to low-cost content eCommerce opportunities for many small and medium-sized businesses.

On social media, everyone is a creator, and every creator has the potential to become a good KOL. It breaks the threshold restrictions of traditional eCommerce, allowing normal people with only a mobile phone to easily step into the stage of content eCommerce, create posts, upload short videos or start livestreams, which can deliver more vivid and real brand content to the majority of users.

With the popularization of the Internet and the rise of social media, the way consumers obtain information has undergone a fundamental change. Traditional ads and blind searches make consumers feel tired. Information and suggestions from online platforms are more real, close to life, and full of personality. The advancement of technologies such as big data, AI, and virtual reality has also provided strong support for the development of content eCommerce.

Behind Multi-Channel: Seek for Stability

Here’s the thing, CBEC insiders have already begun to seek stable development last year.

Looking back at the past few years, the CBEC industry has grown rapidly. However, factors such as market uncertainty, policy changes, and intensified competition have made domestic & overseas brands begin to realize the importance of seeking stability. In this new stage, multi-channel layout has become a key strategy.

Multi-channel layout means that brands are no longer limited to a certain platform or market. In the past, many merchants were over-reliant on a few large eCommerce platforms. Once the platform policy changes or competition intensifies, they will probably fall into a passive position. Now, merchants are beginning to lay out more platforms and move towards local.

In addition, expanding offline channels has also become one of the important strategies of CBEC companies. Many of them have realized that offline channels still occupy an important market share overseas. By cooperating with local retailers and distributors, they push products to the offline market and increase brand awareness and market coverage.

As we bid farewell to 2024, it’s clear that the global cross-border eCommerce is entering a new era of transformation. The rise of China’s CBEC giants has not only reshaped the rules of competition but also pushed industry leaders to adapt and innovate. While price wars and regulatory changes created turbulence, they also sparked creativity and new business modes that are redefining how global trade operates. Looking ahead to 2025, the key to success will lie in adaptability, innovation, and the ability to meet consumers’ ever-evolving expectations. Cross-border eCommerce is no longer just a trend – it’s the future of retail, and its story is far from over.

Don't Hesitate to Contact Us!

If you want to learn more about Chinese eCommerce, or are interested in our services for you to export to China... Please Feel Free to Communicate with Us!