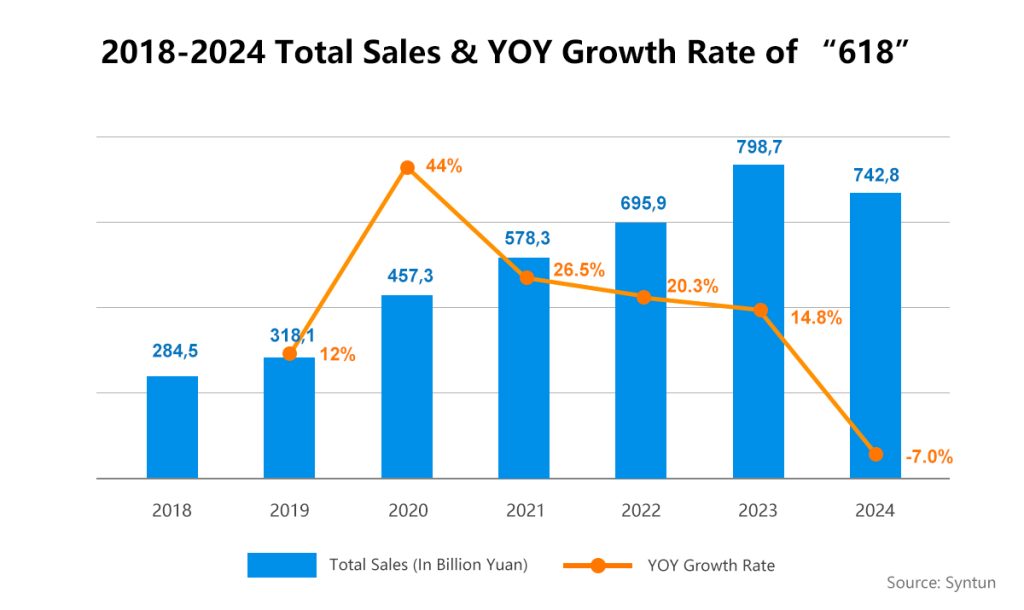

“618”, or China Mid-Year eCommerce “Carnival”, which netizens joked was the “most difficult” in the eCommerce history has finally come to an end this year. As the promotion cycle lengthens and the event has been held for years without attractive innovation, Chinese consumers’ enthusiasm for “618” is certainly decreasing.

During the event, the cumulative sales of comprehensive eCommerce platforms and live eCommerce platforms were ¥742.8 bn (approx. $102.3 bn). Among them, the total sales of the former platforms reached ¥571.7 bn (approx. $78.7 bn), with a year-on-year decrease of 6.9%. Tmall still ranks first among the comprehensive eCommerce platforms, followed by JD, and Pinduoduo ranks the third. The live eCommerce platforms performed well this year, which accumulated ¥206.8 bn (approx. $28.5 bn), and Douyin still played as the leader.

In this year, eCommerce platforms have taken big changes such as the extension of the battle line and the change from pre-sale to spot goods in order to play around “618”, but the focus is still on low prices, or “cost-effectiveness”. In this regard, many Chinese consumers have seen the sincerity of these platforms, but at the same time, coming up with some merchants have said that they can “involution” no more.

Mainstream eCommerce Platform Performance During the “618” Event

JD.com

Sales of exceeding 150,000 small and medium-sized merchants increased by more than 50%. On June 19, official data from JD showed that as of the final minute on June 18, a total of more than 500 million users placed orders on JD’s “618” event. Regarding sales performance, JD’s transaction volume and order volume set new highs in 2024 as the event ended, and its live commerce order volume increased by more than 200% year-on-year.

Tmall

On June 19, data released by Tmall officials showed that as of June 18 ran out of time, 365 brands had exceeded ¥100 m (approx. $13.76 m) in transactions on Tmall’s “618” event, and more than 36,000 brands had doubled their businesses. The number of new “VIP” member users increased by 65% year-on-year, and the membership scale reached a historical record high.

Pinduoduo (Chinese Temu)

Pinduoduo released the top 10 most popular goods in various categories, including fresh food, mobile phones, digital products, home appliances, cosmetics, clothing, sports, mom & baby products, overseas goods and more. Judging from the list, Pinduoduo’s consumer demand is undoubtedly strong from all dimensions, new demands and new consumption in various industries continue to emerge, and the “Billions Subsidy (百亿补贴)”, a unique permanent promotion on Pinduoduo, has become a strong driving force for both supply and demand.

The number of Douyin livestreamers with more than 100 million sales increased by 53% year-on-year, including 34 streams hosted by top KOLs and 47 hosted by brands or store owners. In the realm of fresh food, livestream has become a new focusing method to grow sales. As of June 17, the sales growth rate of livestream in the fresh food industry on Douyin was as high as 261%.

Official data shows that as of June 10, the number of orders during the Xiaohongshu “618” event was 3 times compared with 2023, and the total orders generated by the livestreams was 5.4 times that of the same period last year. Among them, the number of KOLs that achieved single-stream sales of more than ¥1 m was tripled, and also those who measured up to a 100%+ GMV growth was 2.8 times the digits; and finally, the number of stores that hosted livestreams by themselves and gained sales with more than ¥100,000 was 4 times than 2023.

Kuaishou

On June 19, the “Consumer Electronics & Household Products Industry” released their “618” report on Kuaishou eCommerce. Official data showed that, starting from May 20 to June 18 and compared with 2023, brands or retailers involved in this industry accomplished a GMV increased of more than 83%, and the distributor GMV increased by 53%+, and those who do “Board eCommerce Shelves” business gained even more than 177% of GMV growth.

The Most Fierce “618” Event

From the measures taken by various platforms during this year’s “618”, each one of the eCommerce platforms is very “eager” to improve its users, or consumer experiences.

Before the event started, Tmall and JD announced the cancellation of the pre-sale section, and consumers could purchase spot goods directly. The former rule of starting the event at midnight has also been changed, swapping to 4 hours earlier, which is 8 p.m., was more friendly for everyone.

As for the “gameplay”, this year’s mainstream eCommerce platforms have many innovative measures to attract consumers.

JD launched a total of 38 “CEO-Tier Discount Livestreams” during the event, covering categories like clothing, cosmetics, sports, and more. Data showed that on June 3 alone, the cumulative number of audience participating in the fashion brands’ “CEO-Tier Discount Livestreams” exceeded 400 million, and transactions for each livestream rocketed 10 times month-on-month.

Meanwhile, Taobao partnered with Duolingo, a world-renowned language-learning mobile app, and launched 9 language versions of “Tmall 618 Shopping Guide for Overseas Users”, covering Chinese, English, Japanese, Korean, French, Spanish, Italian, German, Vietnamese and other languages.

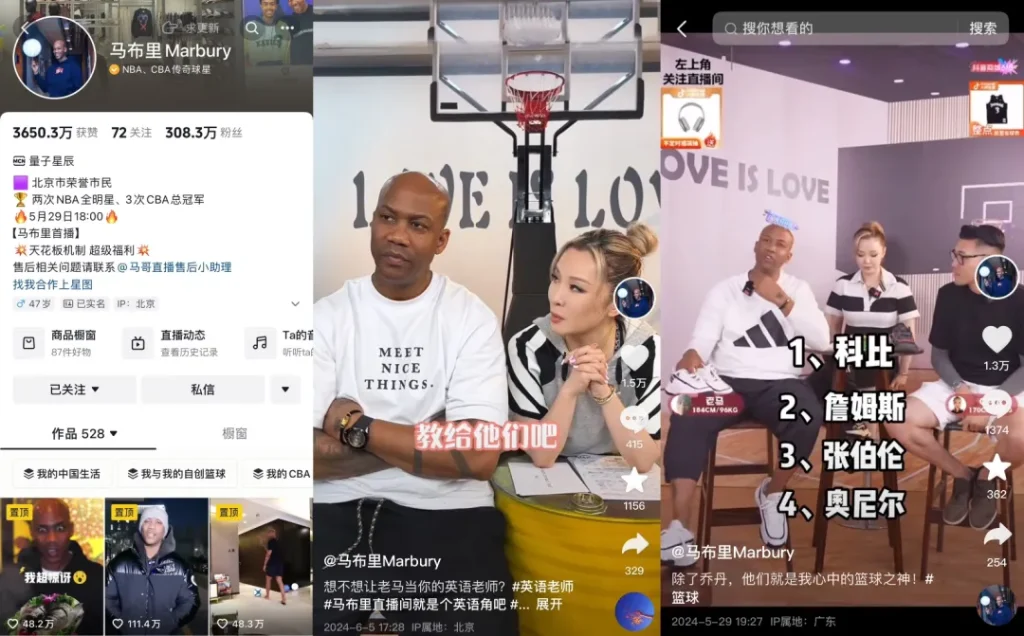

During the festival, Douyin eCommerce linked up with many top-tier content creators to “interact with the old and the new”, and to attempt innovative content. For example, the well-known NBA & CBA player Stephen Marbury introduced basketball shoes based on his experience as a basketball player, and used the “bilingual livestream” to attract the attention of a large number of basketball fans – the first livestream of promoting the most welcomed shoes sold more than 7,000 pairs.

By the way, every eCommerce platform chose to extend the event duration by coincidence, among which Tmall, Pinduoduo, and Kuaishou’s promotion cycle exceeded 1 month.

In addition to the variety of “gameplay”, “low price” is still the highlight. For example, Taotian (淘天), or Taobao & Tmall Group said that they have made a “historically huge investment”, JD announced that “618” focused on “cheap & good”, Pinduoduo launched an “automatic price tracking” service, and Douyin eCommerce also reportedly tested the automatic price change function on closing beta. Although the “gameplay” is diverse, low price is the core.

On June 14, Tmall promised to provide consumers with the largest discount they had ever made, adding 10 billion “red envelope” as subsidies. JD continued to offer subsidies and free deliveries. Data shows that the products launched during JD’s “Billions Subsidy” increased by more than 100% compared to last year, and the number of users and order volume also gained a 150%+ increase.

As mentioned, Pinduoduo’s “automatic price tracking” service is an important marketing service for the platform to improve the operating efficiency of merchants and provide consumers with more price-competitive products. Merchants who agree to activate the service authorize Pinduoduo to automatically modify the prices of its products within a specific adjustment range, price tracking range & cycle based on the sales of the products on the entire eCommerce network and the marketing activities of the platform (no need to be confirmed by the merchant). The platform assists in modifying the relevant prices of the products based on such authorization.

Not only did the platform care about low prices, but luxury brands that used to “show no interest in giving consumers discounts” have also lowered their “status” during the “618” event. Many high-end luxury brands participated, with the highest discounts at 50% off. The products participating in the activities include some popular ones.

Top Streamers went “Invisible”, Consumers more “Rational”

Although the livestream is still the core battlefield of the “618” event, top streamers are “invisible”, and some netizens even joked that the promotion is weak, and even they were “coasting”. We believe that there are two main reasons for this phenomenon. On the one hand, top streamers have been well developed in the early stage, and some of them have switched to a better “track” to push themselves forward; on the other hand, the organization and implementation level of a large number of celebrities and KOLs has been greatly improved.

To be honest, top streamers currently have limited impact on large eCommerce promotions. This is related to their own size and that Chinese consumers pay more attention to goods rather than streamers. Consumers are more rational and wise in online shopping, and the influence of top streamers on consumer shopping behavior is gradually weakening.

The “invisibility” of top streamers has dispersed huge traffic originally gathered on them, which provides more chances for small and medium-sized streamers. However, the disadvantage is that it may lead to a decline in some of the consumers’ shopping experience during the “618” event, and merchants who rely on top streamers to promote goods, may increase their sales pressure.

The imbalance of the livestream eCommerce ecosystem is not conducive to the long-term development of the industry. Therefore, the livestream eCommerce platform is undergoing strategic adjustments and ushering in a new ecosystem. At the same time, the top streamers retreat behind the scenes, which can cultivate more rookie streamers to come to the front stage, making the industry more diversified.

“618” Waned, but still Boosting Consumption

“618” has come to an end. Participants said that this may be the toughest one they have ever joined, and have shown a sense of “exhaustion”. The popularity of these kinds of events have gradually declined, and now, what is the remaining significance of it?

One way or another, large-scale eCommerce promotion events can still stimulate demand and boost consumption. eCommerce events can allow merchants to concentrate on selling goods, increase inventory clearance, and improve the sales efficiency of new products. Understanding user needs is also conducive to brands and merchants increasing their efforts in the research and development of new products. Large-scale eCommerce events can be considered as peak tests for society, platforms, and merchants in terms of logistics efficiency, technical experience, service level, organizational management, process optimization, etc., which are conducive to improvement and innovation under the peak and pressure of eCommerce promotions.

In the new era of Chinese economic development, large-scale eCommerce events highlight their new value. The overall popularity has indeed descent, but they still have a certain positive effect on the operation of the platform and sellers. We cannot only look at their GMV figures.

Some Final Thoughts

After a period of speedy growth, eCommerce and its ecosystem seem to be becoming a very basic infrastructure in China.

At the outset, goods upgrades, contents, designs, packaging, and brands can all be passed on to consumers – they, but also we, are the ultimate payers. But now, the environment has shifted, Chinese eCommerce has entered the era of “lower prices for larger sales”, using the simplest method – low prices to stimulate consumers to place orders, and all unnecessary intermediate price increases are being abandoned.

As the industry gradually enters a stage of high-quality growth, “618” can no longer be simply measured by sales figures.

Don't Hesitate to Contact Us!

If you want to learn more about Chinese eCommerce, or are interested in our services for you to export to China... Please Feel Free to Communicate with Us!

مرحبًا، أعتقد أن هذه مدونة ممتازة. لقد عثرت عليها بالصدفة ;

råb ud og sig, at jeg virkelig nyder at læse gennem dine blogindlæg.