The growth of Chinese eCommerce in the alcohol industry is readily apparent and gaining momentum.

Last year, “cost-effective” has become the keyword in Chinese eCommerce rivalry. As a product with “built-in” traffic, clear price recognition and strong liquidity, alcohols like wine, spirits and liquor have become the market’s “favorite” on all mainstream eCommerce platforms such as Pinduoduo, JD and Taobao.

While the proportion of online alcohol sales continues to ascend, the realm of domestic eCommerce is also experiencing transformative changes.

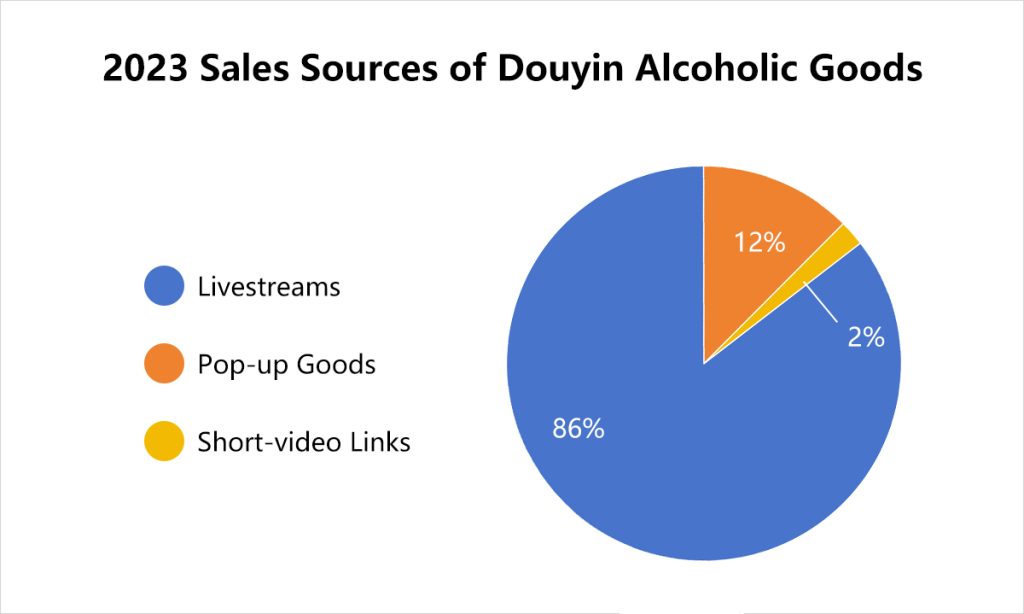

Livestream is a significant breakthrough for the alcohol industry to go online. Douyin(aka Chinese Tiktok) showed that the GMV of alcohol Douyin livestream sales exceeded 30 billion yuan(approx. $4.14 billion) last year, and this digit is expected to pass 50 billion yuan(approx. $6.9 billion) at the end of 2024.

In recent years, the vigorous rise of livestream eCommerce has broken the centralized development pattern of traditional eCommerce platforms such as Taobao, Tmall, and JD, while the deep penetration of online shopping has also continuously raised consumers’ expectations for eCommerce services, “instant order delivery” service provided by instant retail platforms has become a new trend.

As Chinese eCommerce competition intensifies, alcohol has become a category that every platform and channel wants to capture. At the same time, the alcohol industry is also at a critical stage of transformation in eCommerce – they are on a two-way journey.

Traditional Digital Shelf: Alcohol Brands’ Solid Backing

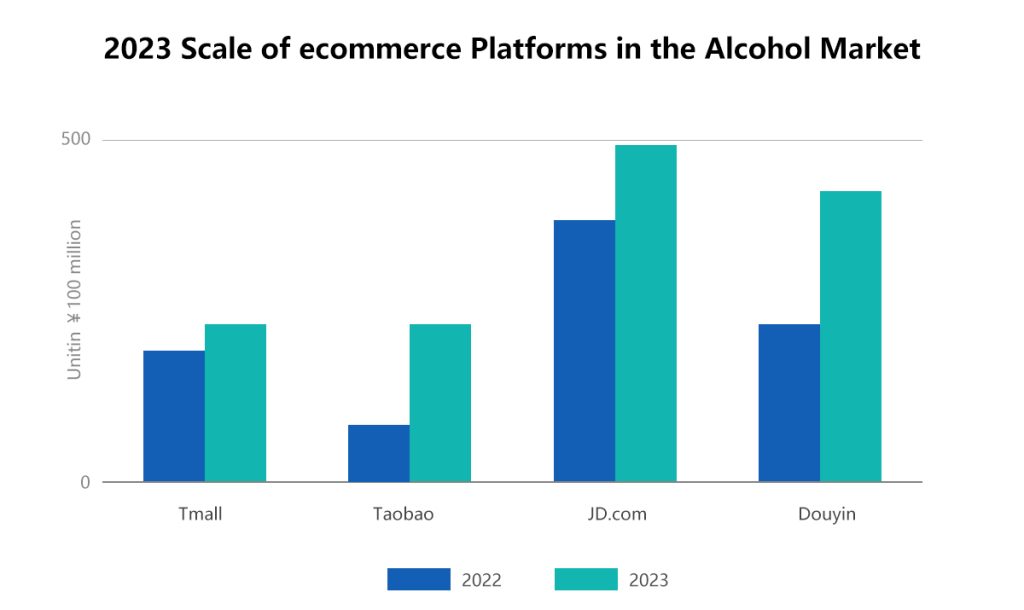

In 2023, the Chinese Internet witnessed two shocking events: Pinduoduo’s market value surpassed Alibaba, and ByteDance’s revenue beat Tencent. Encountered by the sudden, but actually predictable rise of emerging forces, the traditional eCommerce giants have therefore been scrutinized and re-evaluated by many parties and millions of consumers.

For the commercialization of Internet traffic, everything related to eCommerce has become a “battlefield”. And in the meanwhile, Taobao and JD, as representatives of the traditional digital shelf eCommerce platforms, are gradually losing their limelight.

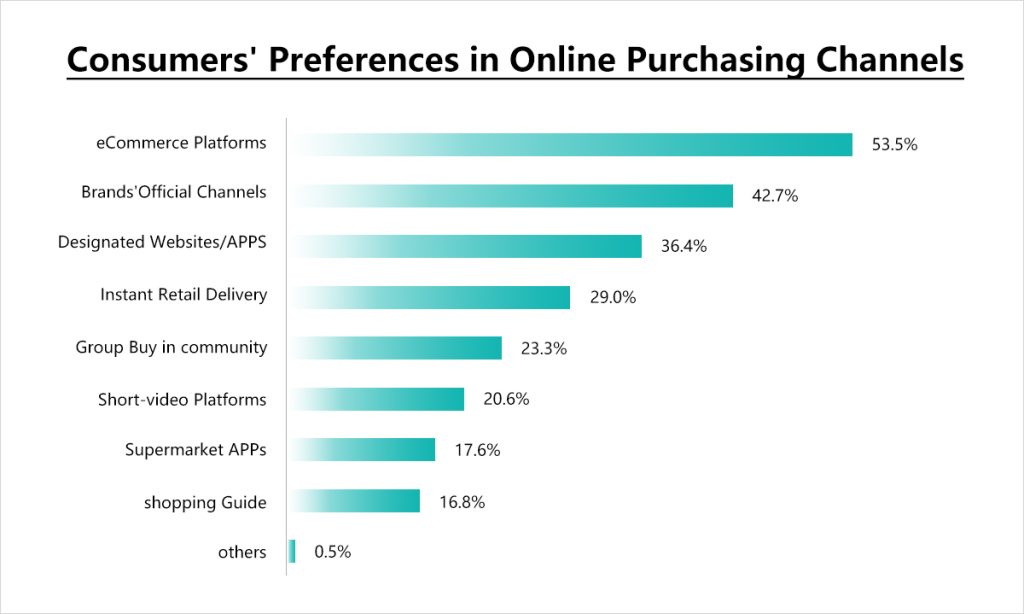

Under the surface of eCommerce traffic, the most essential competitive factors of eCommerce are still supply chain capabilities, logistics infrastructure, after-sale services and stuff, which provide guarantee for the long-term operation on every platform. For brands and retailers, the traditional digital shelf is still the first choice to meet users’ active consumption needs under the logic of “self-directed shopping”, which is also the majority of current eCommerce transactions.

The “store” attribute of the traditional digital shelf is always gaining more attention. Stores play a vital role in connecting brand followers and facilitating word-of-mouth, and with an impressive reputation, it can be a powerful force to drive repurchase and customer loyalty.

Therefore, for those established alcohol brands, traditional digital shelf eCommerce platforms are still a force that cannot be overlooked. Take Moutai(茅台) as an example, among the current mainstream eCommerce platforms, Moutai has only set up a JD self-operated flagship store. Although emerging eCommerce platforms like Douyin and Xiaohongshu are in full swing, Moutai seems to have no interest in settling in. This is largely due to JD’s high-quality logistics services and perfect guaranteed after-sales services, which are consistent with Moutai’s high-end brand tone.

Motivated by factors like the eCommerce ecosystem, quality assurance, and consumer trust, Taobao, Tmall and JD are still the preferred platforms for consumers to purchase alcohol online. Traditional digital shelves are the solid “backing” for a brand, and the same applies to alcohol brands.

During last year’s Double 11 event, Tmall’s alcohol livestream transaction volume exceeded 1.8 billion yuan(approx. $250 million), with a year-on-year increase of 628%, driving domestic alcohol growth by more than 250%. The sales of brands such as Moutai and Wuliangye(五粮液) exceeded 100 million, and the sales growth rate of Langjiu(郎酒), Xijiu(习酒) and other brands exceeded 100%.

However, the shortcomings of traditional digital shelves are also obvious. A great amount of users only open these apps when feel necessary, using them as “tools”. With the current Internet traffic growth saturated, it will be more and more difficult for budding alcohol brands and eCommerce neophytes to start from scratch and rely on traditional digital shelf platforms, rather than choosing Douyin or Xiaohongshu.

Alcohols Livestream eCommerce is on “Viral”

The impact of livestream eCommerce continues.

Douyin and Kuaishou, the two pioneering platforms in livestream eCommerce, have firmly established their presence in the realm. Besides, Xiaohongshu, Wechat Video Account, JD, Pinduoduo, Meituan and other platforms have also stepped up their deployment of livestream eCommerce in recent years. Whether it is the platform itself or brands and retailers from all walks of life, they are all trying to get a share of the livestream market.

In essence, this is the result of “involution”, or “内卷”, under the rivalry of Chinese eCommerce. The foundation of livestream is built upon compelling “content,” and the strategic approach adopted by many livestream eCommerce platforms closely mirrors Douyin’s “interest-driven eCommerce” model. This entails capturing users’ or viewers’ interest through engaging content and subsequently cultivating potential consumer demand, or we can say, “create demand, even if they don’t need it.”

For the Chinese eCommerce market, alcohol is a late entrant, and most alcohol brands no longer have the first-mover advantage on traditional digital shelf eCommerce platforms. Livestream is the key to alcohol eCommerce layout.

2023 was a year of great significance for alcohol brands to embrace eCommerce. Well-known brands, especially baijiu(白酒, or Chinese spirits) brands like Wuliangye, made the most of the trend. During the Double 11 event period in 2023, the overall growth of alcohol in the realm of eCommerce was 78%, along with more alcohol brands scheduled to do livestreams by themselves.

For content-focused eCommerce platforms such as Douyin, Xiaohongshu, and Kuaishou, their advantages lie in traffic, and they have a steady demand for high-quality supply. Alcohol has now become a leading category for livestream eCommerce. The content-focused platform occupies the center of current Internet traffic, providing prerequisites for the eCommerce development of alcohol. Therefore, livestream eCommerce provides more opportunities for small and medium-sized alcohol brands.

In addition to traffic benefits, alcohol consumption also pays more attention to emotional value. In the livestream scenario, the streamers’ vivid product explanations and promotions make it easier to mobilize consumers’ emotions to place orders. Therefore, livestream is also becoming a relatively direct and efficient alcohol sales channel.

However, on the other side of the popularity of alcohol livestreams, is that industry chaos is impossible to avoid. The entry threshold and platform supervision of livestream eCommerce are much lower than those of traditional digital shelf platforms. Selling fake alcohol, or creating fake sales volume to deceive consumers, and low-price dumping happens quite often, which has a negative impact on building consumer trust in the platform and brand, and also brings certain adverse effects on brand power.

It is worth mentioning that the “low-price” attribute of livestream provides brands with room to do stock clearance. In the current situation where alcohol brands and retailers’ inventories have been high in the past years, livestream acted as another inducement for alcohol retailers to accelerate their entry into livestream.

Alcohols Instant Retail: Transformation of Chinese eCommerce Platforms

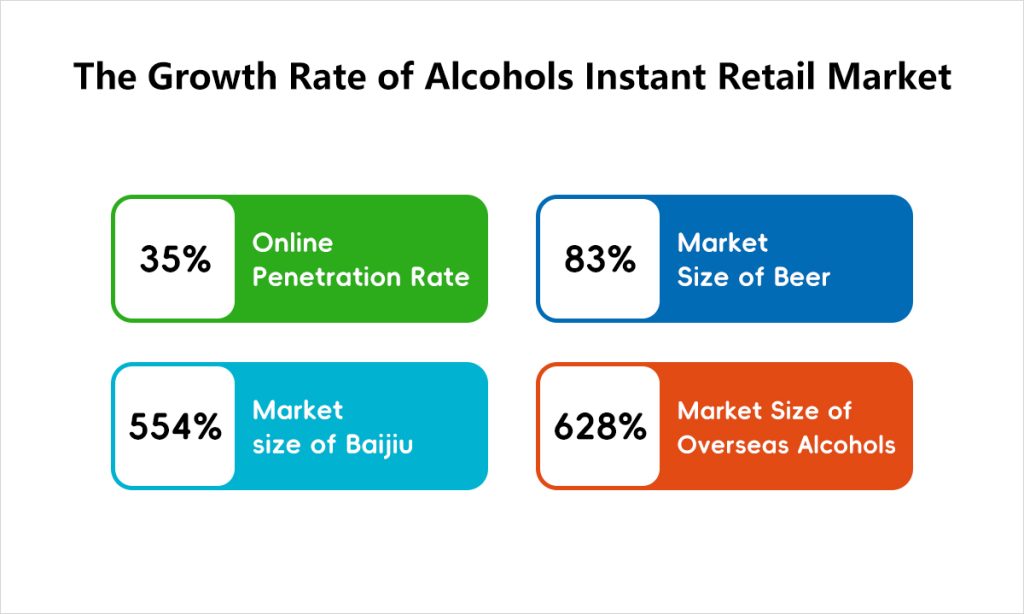

Brick-and-mortar and eCommerce, the two that have long been opposed to each other, have stood together for the first time in the Chinese market because of the rise of instant retail.

Local supply accompanied by instant delivery, “instant retail” services represented by Meituan and “JD-to-home” are driving a large number of offline merchants to join online. Among them, Meituan has strong domestic consumer loyalty and a team of 8 million “riders” to ensure every delivery, while JD-to-home’s advantage lies in its eCommerce supply chain support and self-operated logistics. Therefore, the two occupy the first-mover advantage in instant retail.

In the self-operated scenario, the demand for instant consumption of alcohol is high, and is a top-tier type among instant retail platforms.

Meituan’s layout for instant retail mainly lies in the platform’s self-operated supply chain, as well as other 3rd-party offline alcohol retailers’ entering; JD’s instant alcohol retail includes its own “JD-to-home” services and its offline chain stores to accomplish alcohol deliveries.

It can be seen that platform self-operation alongside 3rd-party offline merchants are the two directions of the current instant alcohol retail layout. Would it be fair to say that eCommerce platforms are setting off a battle with offline alcohol retailers, or that eCommerce allows brands and retailers to take advantage of more opportunities?

The instant retail of alcohol is at the forefront of the eCommerce market’s layout, and its size is accelerating.

Instant retail sales of alcohol or alcoholic beverages are not only in compliance with consumers’ demands for more extreme logistics speed, but are also a starting point for various alcohol brands and retailers to build brand-quality consumption.

Compared with traditional digital shelf eCommerce platforms, instant retail has brought greater opportunities to brick-and-mortar alcohol retailers.

The evolution from traditional digital shelves, to livestream eCommerce, and now instant retail, signifies the prevailing development trend within the domestic eCommerce landscape. As Chinese eCommerce enters a phase of relative maturity and stability, each platform strives to capture a larger market share through diverse modes and channels. Despite this, their inherent strengths and distinct positioning remain prominent. Consequently, various alcohol brands also find it imperative to leverage these platforms as entry points into the market.

Don't Hesitate to Contact Us!

If you want to learn more about the Chinese eCommerce, Or are interested in our services for you to export to China... Please Feel Free to Communicate with Us!