What is China Cross-Border E-Commerce (CBEC)?

Definition of China Cross-Border E-Commerce (CBEC)

The term "China cross-border e-commerce" is used to refer to the international sale of any product or service between two parties interacting through an online marketplace platform in China.

Three eras of China Cross-Border E-Commerce development

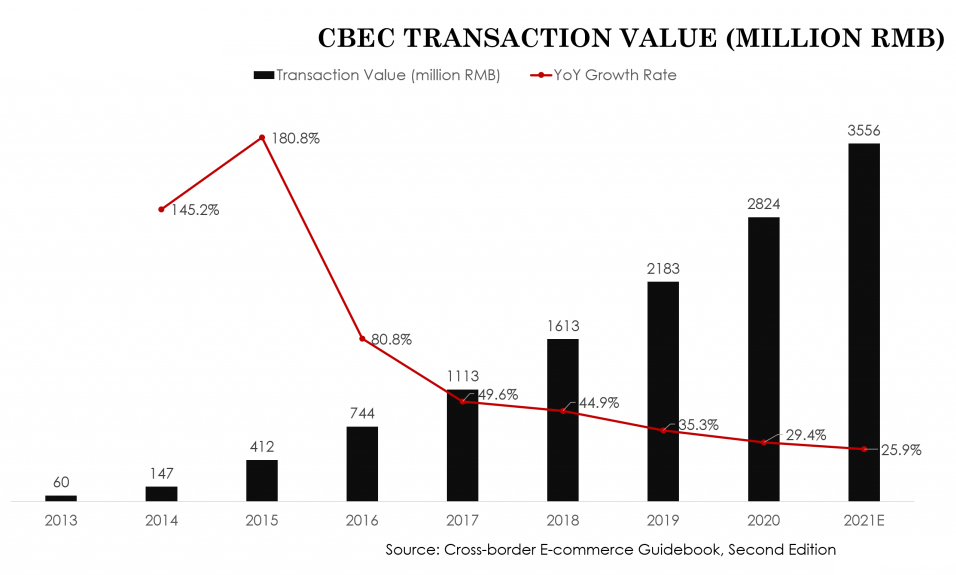

● The imported model of the China CBEC has grown substantially in these ten years.

According to the analysis chart, CBEC(cross-border e-commerce) status can be separated into three eras:

· CBEC 1.0 | Personal overseas buyer era | 2005-2007

· CBEC 2.0 | Online overseas shopping era | 2007-2014

· CBEC 3.0 | CBEC era | 2014-now

During era 1 and era 2, due to the high demand for foreign goods in China, Chinese consumers also have another common method of online shopping–daigou. This is an illegal activity where daigou shoppers buy desired items from outside of China and then mail them to China or put them in their luggage on return. Once the goods arrive in China, they are sold for profit. Due to many non-compliance declarations of daigou, customs inspections and penalties have been tightened, which has gradually become marginalized.

In 2020, spending through daigou shoppers contributed a staggering 70% to 80% of the 230 billion yuan ($35 billion) spent by Chinese consumers in overseas luxury markets. Demand for these goods will grow further in 2021. Additionally, this shopping trend is likely to continue into 2022 as fewer Chinese travel to overseas countries during the pandemic.

It can be seen that since China entered the CBEC era, the transaction volume of CBEC has entered a stage of rapid growth. Even under the problematic epidemic COVID-19 situation, China’s CBEC still maintains a high growth rate of about 30%. Recognizing these benefits, the Chinese government has been quite supportive of this trade model and has embarked on issuing a series of policies to regulate it over the years.

These regulations ranged from an initial notification in 2013 establishing that e-commerce retail imports through bonded warehouses would be treated as personal articles, until new measures were introduced in 2016, equating retail imports with general trade goods. In addition, these new measures include tax incentives and publishing a list of Goods under CBEC Retail Import, including 1,240 items authorized to be imported through CBEC.

CBEC Pilot Regions

Definition of CBEC Pilot Regions

The CBEC Pilot Zones are designated areas, usually close to large trading ports, that provide a positive business environment and infrastructure for CBEC activities. The main characteristic of these pilot zones is the so-called bonded warehouses.

Advantages of CBEC Pilot Regions

Initially, the advantages of these pilot zones were that they allowed for a shorter physical distance between the product and consumers. Chinese companies are able to minimize delivery times and costs by shipping directly from the bonded warehouse to the end buyers.

Moreover, Chinese Cross-border E-Commcerce has a special distinction: international companies can sell their products to Chinese customers at a preferential tax rate without requiring a license to operate a business in China. It means that no import licenses or test reports were needed, and only a one-time company and product registration was required.

Furthermore, lower taxes on brands using bonded warehouses make it easier and cheaper for CBEC pilot zones to launch new and unknown products from abroad. The pilot zone promotes the development of CBEC.

What is the process of exporting products to China?

Beautinow's customer complaints are much less than before, and its reputation in China is getting better and better.

Depending on the product type and target market, there are several ways to export products to China.

There are three main ways to export your goods to China:

1-Universal Postal Union (UPU): This is an informal way that allows you to send small packages in China, which is a great method for SMEs. It does not require an import license from the general administration, but depending on your product, the product may be subject to duties up to 15/30/60%. The total value of 6 products must not exceed RMB 1,000, and they need to pass the customs clearance inspection of China's import restrictions and prohibitions (see FedEx website).

2-B2C import: It is a formal export mode where the package is declared through the platform, and the customs are reminded to clear it. It's a great way to ship products like food, cosmetics, and high-end consumer goods.

3-Bonded import model: This one is a little more complicated model because it requires export products to be stored in places such as Hong Kong or a special area for cross-border e-commerce. These shipments correspond to goods, such as low-value goods, consumer goods, or heavy goods vehicles.

China CBEC tax and customs regulations

Keep in mind that for the last two methods above, cross-border logistics are subject to import tax, VAT and consumption tax (product tax is roughly 11.2% for the largest category of products or 25.5% for high-end cosmetics, luxury care and fragrances).

You can also ship your products to the Chinese border (e.g. Hong Kong) where they will be stored before being delivered to the customer. The good thing is, if no one buys in China, you can still sell through other cross-border e-commerce platforms in Asian countries.

Since 2016, a "positive" product list has been approved, resulting in a preferential rate of 11.9% import duty on certain goods. These shipments are also exempt from the extra time for customs clearance and do not require import permits or other certificates and regulations.

Current status and future trends of CBEC

With the most internet users in the world, Chinese consumers buy these products online naturally and rely on China's CBEC platforms. In the past 5 years, China’s CBEC has grown nearly tenfold. About 68% of Chinese consumers believe foreign products are of better quality, especially in:

Cosmetics & beauty products

Baby formula

Fashion & jewelry (luxury brands)

If you are interested in the categories imported to China, please check out what types of products are suitable for export to China.

These industries make up the largest portion of e-commerce imports.

In 2020, China CBEC imports reached a value of 88.2 billion USD, an increase of 16.5% over 2019.

Since the first approval to carry out CBEC pilots in 2015, more and more pilot cities and regions have been approved to do so. In January 2020, China announced that they would expand the pilot areas of CBEC to 50 cities, including Hainan Island and Jinan, Lhasa, and Urumqi.

In 2022, the State Council of China sets up 46 new cross-border e-commerce pilot zones, where enterprises can enjoy preferential tax policies and simplified customs procedures. Currently, the total number of such regions in China is 105. When companies sell to Chinese consumers from these regions, they benefit from reduced import duties, reducing their overall taxation.

Products imported through CBEC enjoy preferential tax policies. If the annual transaction volume of imported products does not exceed 26,000 RMB, for products with a value of not more than 5,000 RMB, the import tariff is 0%, and the value-added tax and consumption tax are exempted by 30%.

As China has experienced the Covid-19 upheaval, CBEC has played a crucial role in supplying daily necessities and keeping global supply chains moving. CBEC retail import has become an essential channel for mainland consumers to obtain imported products, and is expected to play a more critical role in China's supply chain in the post-epidemic era. This channel also provides companies with an alternative to general imports to sell imported goods to the mainland. Businesses should adapt to digital supply chains early to stay afloat and prosper.

If this article still can’t solve your doubts about China CBEC, please check Chinese Cross-Border E-Commerce 2023 latest guide.