What is Fitness?

Fitness embraces various kinds of sports, inclusive of gymnastics, yoga, etc., which can enhance one’s flexibility, endurance, and coordination; swimming, brisk walking, jogging, and cycling, these aerobic exercises can strengthen your heart; weightlifting, dumbbells lifting, and other repetitive stretches & bends build muscles, which in addition, burns calories, increases bone density, reduces the chance of injury, especially to joints, and prevents osteoporosis.

With the upgrade of Chinese consumption level and concept, driving the willingness to seek for healthy and desirable lifestyle, more and more people begin to pay attention to fitness, making to a brisk expansion of the fitness market in China — the number of fitness rooms is exploding, sales of related equipment is booming, as are health/fitness app downloads.

Catching up with the pace of the world, China has jumped on the fitness bandwagon.

A Brief Overview

Population & Penetration

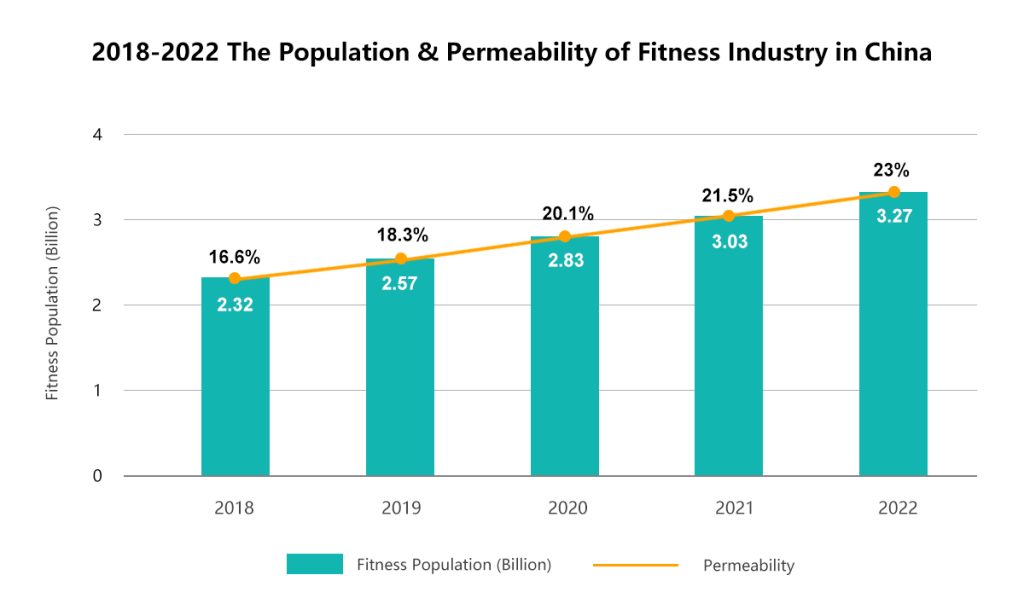

The fitness industry in China started to gain attention relatively late. In recent years, driven by China’s sports policy, the penetration rate has increased annually. As the data shows, in 2022, the population of fitness people in China has reached 327 M, with a penetration rate of 23%. And it is estimated that by 2026, the penetration rate will rise to 29.3%, and the population will be 416 M.

Market Size

The market size of China’s fitness industry has continued to enlarge of late. Although affected by the COVID-19 pandemic during 2020-2022, causing the offline fitness market has almost stagnated(the fitness market in 2022 was about ¥255.9 B, a decrease of 6.64% compared to ¥274.1 B in 2021, the specific performance of the market is that the closure rate of fitness rooms has skyrocketed), the online and at-home fitness market, however, has grown on a large scale, making the fitness market as a whole show a continuous progress trend.

Still, it is now halfway through 2023, and the fitness market in China has finally achieved a “comeback.” As reported by the latest data for Q1 in 2023, various operating data indicators of offline fitness rooms are recovering rapidly — the number of various offline fitness rooms has increased significantly, and the number of paid fitness members, average personal consumption expenditure, activity level, training frequency, and other data also approached the status of the same period in 2019.

Fitness Industry Highlights

New Image for Chinese Fitness Consumers

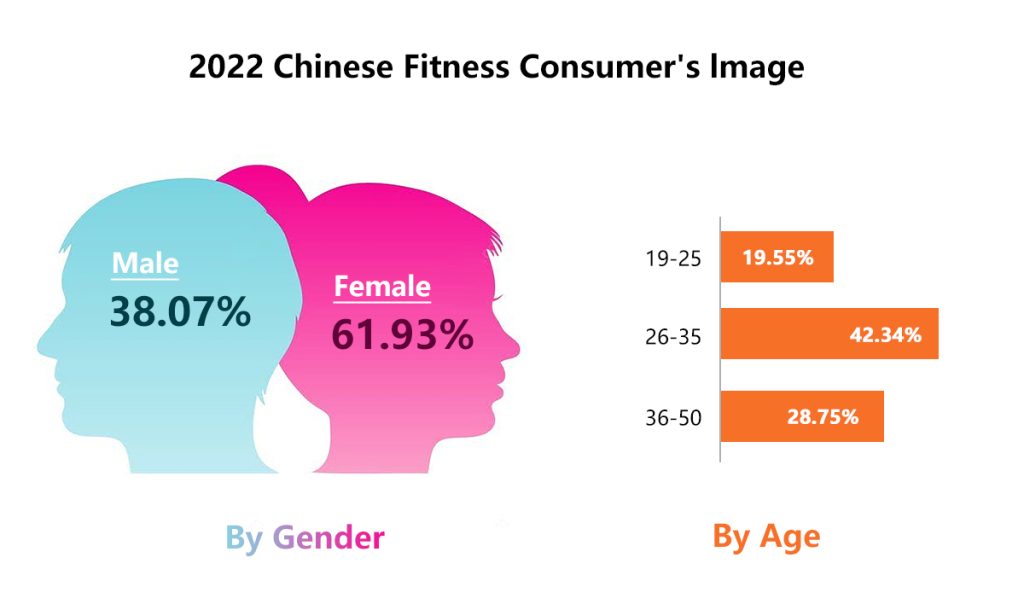

Affected by the COVID-19 pandemic, most Chinese people spend much more time at home than before. And those TOP social media platforms in China have seized the opportunities of their advantages through short videos and livestreams (a method of KOL marketing), making the number of Chinese people who choose to do workouts at home increase sharply as a whole. Among them, females have become the leading force in the fitness consumer market. In the meantime, more smart fitness equipment and gadgets hit the shelves, such as smart fitness mirrors, skipping ropes, and yoga mats, introducing more workout methods for people to exercise indoors. With supply and demand going “hand-in-hand”, Chinese consumers’ fitness initiatives and investments have been enhanced.

The survey shows that female fitness consumers occupied the whole market in 2022 at about 61.93%, which is a rapid increase compared with 2021. Female fitness consumers behave more actively, and the gap between the proportion of females and males has widened. Besides, from the perspective of age, people aged 26-35 have the strongest spending power, accounting for 42.34%, followed by groups aged 36-50 and 19-25, accounting for 28.75% and 19.55%, respectively.

Purpose of Fitness

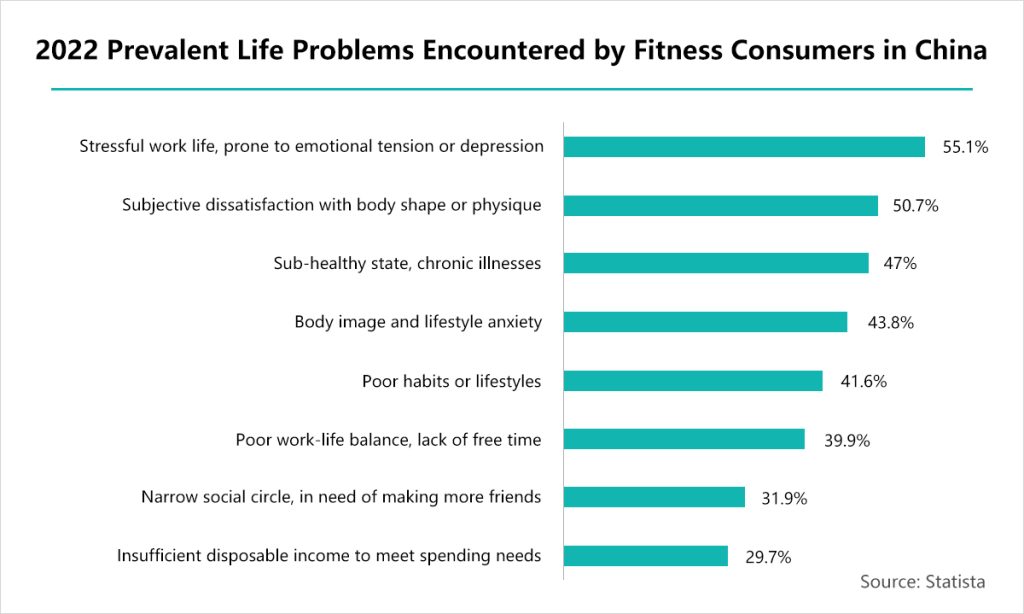

Chinese people are now living fast-paced life, especially for office workers. In accordance with Statista, more than 55% of them said that they need to work out because they feel anxious or depressed due to stressful work life. And more than half of respondents were also dissatisfied with their body shape or physique, while many suffered from chronic diseases, poor lifestyles, or angst about their body image. A particular group of people is also trying to broaden their social circles to make more friends by engaging in fitness. All of these concerns are factors affecting the demand for fitness.

Smarter Fitness is Dominating Chinese Market

With the increasing requirement for fitness, the fitness industry in China has developed speedily — it has begun to transform from offline to online with the blessing of cutting-edge technologies such as the Internet, artificial intelligence, and big data. For the moment, numerous active Chinese GenZs have embraced a healthier lifestyle, joining gyms and workout classes or buying their own exercise equipment. And the Covid-19 pandemic has acted as a catalyst, changing people’s lifestyles, including how they exercise.

The fitness craze in China has also been encouraged by the government, which announced a five-year plan to invest ¥1.5 T(for instance, build public sports venues and place public sports facilities) in improving citizens’ fitness levels and fighting obesity. This decision is primarily aimed at teens, who are the potential to maintain good fitness habits even they become older.

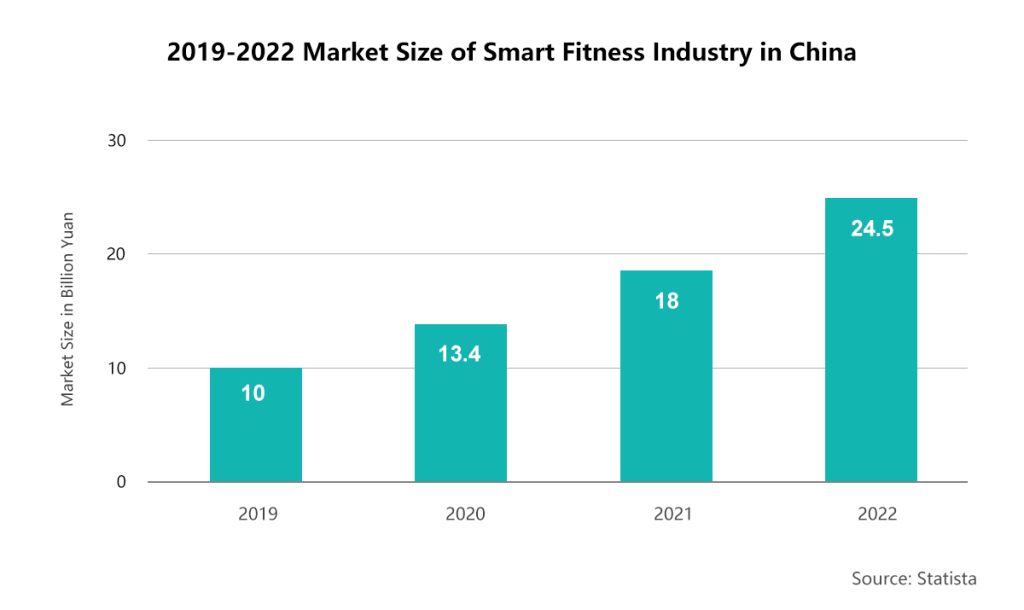

China’s digital fitness market is as well promising — in 2022, the size of the smart fitness industry in China has already reached ¥24.5 B. The key drivers for the market’s growth are rising fitness awareness and increasing demand for user-friendly and self-monitoring devices. Emerging trends include the integration and cross-compatibility of personal health data and the introduction of cross-products.

Smart wearable fitness equipment is one of the most popular products in the market. It is currently foreseeable that in the segmented market, smart bracelets and watches are expected to show a continuous and significant growth trend due to their multi-functional features, and will occupy the largest market share among many smart fitness products for a long time.

Customarily, smart bands include GPS positioning and functions suitable for different exercise content, including but not limited to workout goal reminders, sleep quality detection, calorie consumption, heart rate monitoring, and the most basic — step counting.

Fitness apps also sprung up during the COVID-19 pandemic. They show that over 100 M mobile users have installed at least one fitness-related app on their phones.

The emergence of diversified fitness apps also plays a pivotal role in assisting the government’s efforts to improve the quality of life and health of the elderly. Facing an aging society, the Chinese government very much hopes that people of all ages can actively participate in fitness activities.

Future Trends of the China Fitness Market

According to data released by the China National Bureau of Statistics, in the first quarter of 2023, the median per capita disposable income of Chinese urban residents was ¥12,175, with an increase of 3.9%, and the per capita consumption expenditure was ¥8,303, the increase was 4.8%. Against the backdrop of rising Chinese consumer consumption, and as a vital part of the sports industry, the fitness industry will also lead to various segments’ overall recovery and growth.

With the improvement in living standards, the Chinese have started to pay more attention to physical health and realize the necessity of workout to an increasing extent, and further, young people will be more inclined to choose to engage in mental work rather than physical work, so that they can have more disposable time for workouts.

These years, a significant group of offline fitness people is gradually transforming online. With the rise of Chines social media platforms such as Douyin(Chinese Tiktok), RED(Xiaohongshu), etc., the popularity of at-home fitness was boosted, and it seems to have the tendency to become mainstream. It is estimated that the proportion of the online fitness market will increase from 47% in 2021 to 61% in 2026, surpassing the offline fitness market.

Edge technology will continue to reshape the Chinese fitness market in the coming years. Fitness studios equipped with high-tech equipment are expected to be more competitive in the market, and those low-tech ones will face questioning and blame from consumers who can obtain professional information from various online channels. In addition, the consumption of high-tech sportswear and wearable devices is expected to increase.

China’s fitness industry will inevitably combine online services with offline operations, and is committed to providing consumers with more personalized, convenient, and goal-oriented services.