In China’s fast-paced and tech-savvy landscape, with an increasing number of people utilizing mobile devices such as smartphones, smartwatches, and tablets for their everyday needs, traditional payment methods are being rapidly replaced.

The rise of cashless mobile payment systems has become an integral part of daily life, seamlessly connecting consumers with merchants like never before, making shopping quicker and easier than ever before.

Overview of Mobile Payments in China

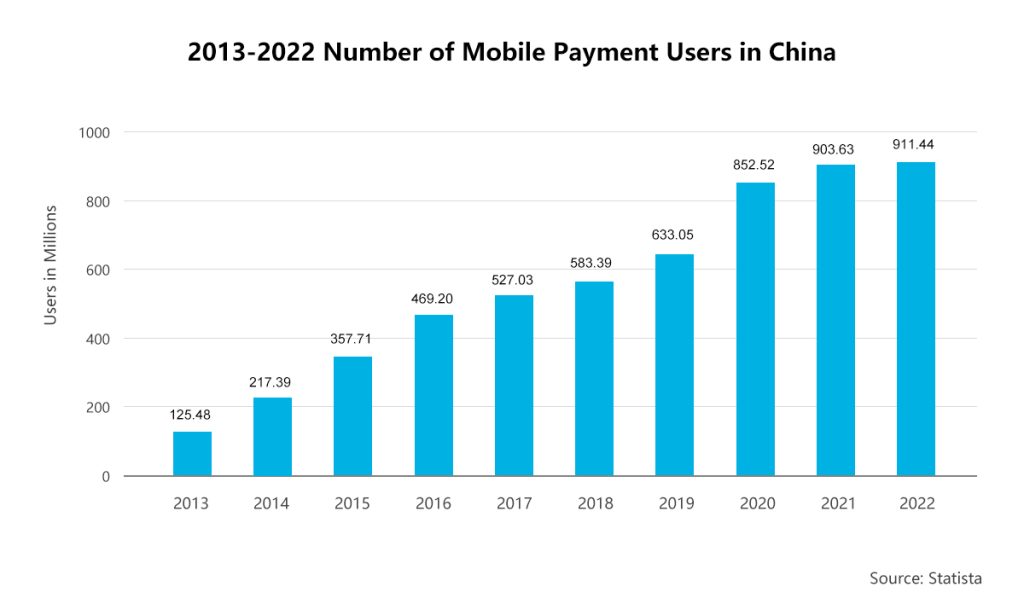

In 2022, an astounding 911 million people in China embraced the convenience and efficiency of mobile payments. While the growth rate of new users had started to taper off after 2017, the outbreak of the COVID-19 pandemic brought about a surge in adoption as more individuals sought contactless payment options. Over time, the number of people equipped with mobile payment capabilities has steadily risen year by year. Although recent increases may not appear significant on their own, when considering penetration rates, it becomes evident that nearly all Chinese citizens now have access to and utilize mobile payment services. The widespread integration of this technology reflects its remarkable impact on transforming the traditional commerce landscape into a cashless society.

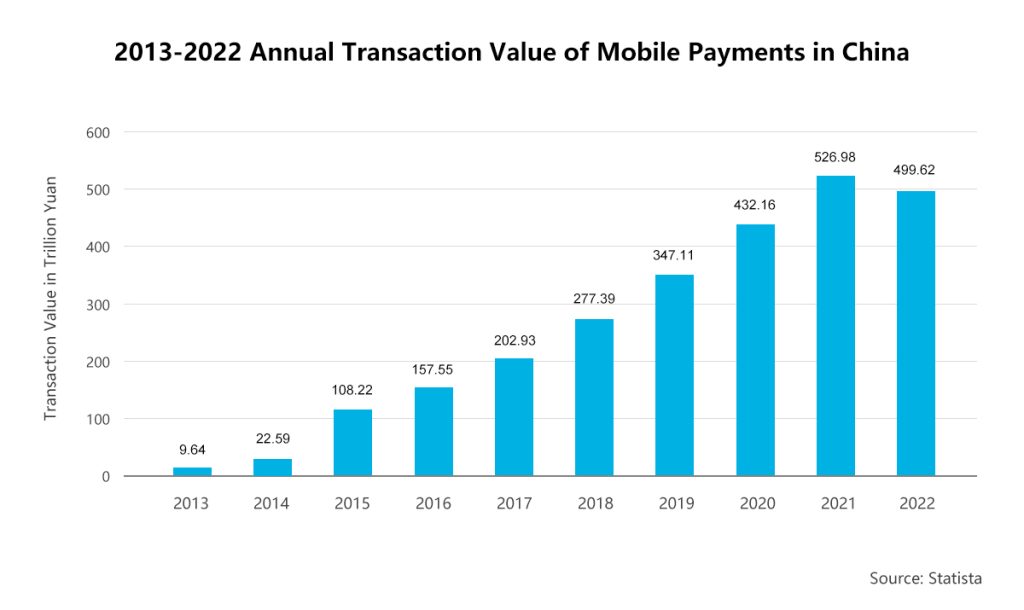

In the past year, China’s mobile payments experienced a slight decrease in total transaction value, amounting to around ¥500 trillion. However, this figure still represented an impressive increase of approximately 15% compared to the previous year and nearly double the amount recorded in 2018. The sheer scale of mobile payment transactions in China is awe-inspiring, with more than 158 billion transactions taking place throughout 2022 alone.

2 Mobile Payment Giants in China

Tencent and Alibaba have revolutionized the landscape with their dominant mobile payment platforms, WeChat Pay and Alipay. Today, mobile payments have become not just a convenient option but an integral part of daily life for Chinese consumers. With their seamless user experiences and robust security measures, WeChat Pay and Alipay have established themselves as trusted platforms for transferring money across various contexts. Whether it’s making purchases online or offline, settling bills at restaurants or stores, or even sending funds to friends and family members – mobile payments offer unparalleled convenience that is reshaping traditional payment practices.

WeChat Pay

WeChat Pay, introduced as a feature within the WeChat super-app in 2013, has quickly gained immense popularity in China’s mobile payments realm. Its seamless integration into the widely used WeChat platform offers unparalleled convenience for users who prefer to conduct transactions using their mobile phones. Boasting more than 1.26 billion monthly active users and an extensive ecosystem comprising 20 million official accounts, 68 million uploaded videos daily, and 70 million Mini-Programs, WeChat stands as the largest and most popular all-in-one social media platform in China.

Given this vast user base and thriving ecosystem, it comes as no surprise that WeChat Pay is one of the most widely adopted mobile payment systems among Chinese consumers. The sheer market share speaks volumes: with over 900 million monthly active users utilizing WeChat Pay regularly. Leveraging the various functionalities of the app itself, such as messaging services and social networking features, alongside its robust payment service capabilities, WeChat Pay provides a comprehensive solution that caters to diverse consumer needs within a single platform.

Alipay

In 2004, Alibaba pioneered the launch of Alipay, which became the first mobile payment platform in China. This groundbreaking introduction revolutionized the payment landscape within the Middle Kingdom and set a new standard for digital transactions.

Beyond its dominance within China, Alipay also holds the distinction of being the world’s largest mobile payment provider. As of 2023, it boasts an impressive user base of 1.3 billion individuals globally. One significant factor contributing to its popularity is its close integration with Taobao and Tmall, two of China’s most prominent eCommerce platforms under Alibaba’s umbrella. Given that WeChat Pay is not accepted on these platforms due to Alibaba’s policies, Alipay has become the go-to payment method for users purchasing on these sites. This exclusivity strengthens Alipay’s position as a preferred choice among Chinese consumers.

To reinforce their reach and accessibility further, Alipay has developed strategic partnerships with numerous major Chinese national banks along with dozens of local commercial banks across the country. These collaborations expand their coverage and enable seamless transactions for users while fostering trust in their services.

Types of Mobile Payments in China

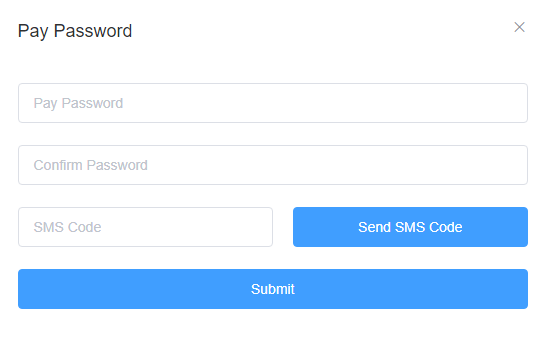

Password

One of the most classic and basic methods for buyers to confirm purchases is by entering a payment password set by the user during the transaction, which serves as an additional layer of security, ensuring that only the rightful owner can complete the payment operation. By entering the correct password, buyers can successfully authenticate and authorize their transactions, providing peace of mind in securing their financial information and completing secure payments.

Fingerprint

Fingerprint payment offers users a convenient and streamlined method to complete transactions. By registering their fingerprints in advance at the payment end and associating them with their bank card, consumers can enjoy effortless payments. When making a purchase, all it takes is a simple touch of their registered finger on the payment device to authenticate and authorize the transaction – a tap that eliminates the need for entering passwords or PINs, saving time during checkout processes. With its seamless user experience, fingerprint payment provides a hassle-free way for users to make secure payments with just a touch of their finger, enhancing convenience in day-to-day financial transactions.

Facial Recognition

Face-swiping, or facial recognition payment, utilizes cutting-edge technologies such as artificial intelligence, machine vision, and 3D sensing to provide a seamless and secure payment experience. With face-swiping payment, users can complete transactions by simply swiping their faces through a dedicated device. This innovative method harnesses the power of facial recognition technology to verify the user’s identity and authorize real-time payments accurately. By eliminating the need for physical contact or manual input, face-swiping payment offers a convenient and hygienic solution that aligns with the modern demands of fast-paced transactions.

NFC

NFC (Near Field Communication) payment allows consumers to make purchases by simply tapping or waving their handheld device near a compatible payment terminal. This contactless method works offline, eliminating the need for a network connection. It offers fast and convenient transactions without physical cards or cash, streamlining the checkout process for users and merchants alike. NFC payment provides a secure and efficient way to pay while ensuring compatibility across different devices and terminals.

More Methods in the Future...

During the 2023 Smart China Expo (SCE 2023) in Chongqing, WeChat unveiled its palm print-based technology integrated into power bank rentals. This innovative feature will be launched in Shenzhen’s Coastal City starting September 5th. By harnessing the power of the palm, users can enjoy enhanced payment convenience for power bank rentals, eliminating the need for batteries or other traditional payment methods. With this advancement, users can effortlessly access and utilize power banks with an easy palm touch, making charging on the go even more convenient and hassle-free.

Beyond Convenient

At first glance, mobile payments may appear to offer only the convenience of cashless shopping.

Advantages for Consumers:

- Convenience: Quick and easy transactions without physical cash or cards.

- Accessibility: Greater access to financial services, promoting financial inclusion.

- Security: Advanced measures protect sensitive information, reducing the risk of fraud.

- Rewards and Loyalty Programs: Incentives such as points, discounts, and cashback.

- Seamless Integration: Integration with other services for a seamless user experience.

Advantages for Companies/Sellers:

- Increased Sales: Expand customer reach and boost revenue.

- Cost Efficiency: Reduce transaction costs and eliminate the need for physical infrastructure.

- Streamlined Operations: Automate payment processes and integrate with inventory management.

- Enhance Consumer Experience: Provide convenient checkout options and improve customer satisfaction.

- Data Insights: Gain valuable customer behavior data for marketing optimization.

- Security: Ensure secure transactions and build trust with consumers.

However, what mobile payments can do goes beyond the surface.

Mobile payments can inadvertently reduce costs on essential items, such as food and daily necessities, which is particularly beneficial for rural households that may lack access to traditional financial services like banks. By making shopping easier and more accessible, mobile payments can boost rural household consumption and foster economic growth in these communities.

Furthermore, mobile payments open doors to new businesses with opportunities. They empower small entrepreneurs, making them more agile and willing to take risks. The availability of micro-lending services through mobile payment platforms eases credit constraints and allows entrepreneurs to seize opportunities they might have otherwise missed. This dynamic environment promotes innovation and economic growth.

Fun fact: mobile payments have been linked to increased happiness, especially in rural areas. This can be attributed to the convenience they offer, allowing people to seamlessly pay for a wide range of goods and services. The ability to conduct transactions using mobile payments effortlessly enhances overall well-being and satisfaction.

China actively promotes the involvement of banks and payment platforms in mobile payment services, aiming to streamline enterprise operations and cater to the growing demand for cross-border eCommerce transactions. This strategic approach not only facilitates smoother business operations but also acts as a catalyst in attracting a more significant number of entrepreneurs and investors into the realm of mobile payments.

By fostering an environment supporting mobile payment innovation, China is positioning itself as a global digital payment landscape leader.