With the development of the Internet, logistics, warehousing, and stuff related, the Chinese Cross-Border eCommerce (CBEC) has become a new force in world trade by leveraging its advantages such as online transactions, contactless deliveries, and short transaction chains to help consumers and brands or retailers from all over the world to “Buy & Sell Globally.” As 2024 proceeds on, the realm of Chinese CBEC has already entered a new stage of development and facing greater challenges and opportunities.

The rapid development of global CBEC not only helps Chinese products reach the world, but also becomes a significant channel for goods from overseas to enter the Chinese market.

In the first quarter, according to preliminary estimates, China’s CBEC imports and exports were about 577.6 billion yuan(approx. $80 billion), showing an increase of 9.6%; of which, exports contributed 448 billion yuan(approx. $62 billion) and imports took the rest 129.6 billion yuan(approx. $18 billion). Benefited by the gradual recovery of the economy, the Chinese CBEC industry will continue to develop healthily at a compound annual growth rate of 16.4% in the next 3 years, and the market size is expected to exceed 10 trillion yuan by 2025.

The content above just a brief overview of the Chinese eCommerce market, and here, let’s get back to the title, and show our valued reader, of course is you, that in 2024 the Chinese CBEC business will present 3 major new trends, which will further promote the upgrading and development of the entire industry.

Three Major Trends of the Chinese CBEC Industry in 2024

1. Sink in Channels and Prices

Since last year, 2023, Pinduoduo(拼多多) has performed extremely well in the realm of the Chinese eCommerce, and has become the central issue of the market. According to its financial report for the third quarter of 2023, its performance far exceeded expectations, and its market value was once as high as $195.9 billion, surpassing Alibaba and becoming the largest Chinese Concept Stock in the US market.

Based on another financial report data, Temu, Pinduoduo’s CBEC platform which faces overseas consumers, has performed very indispensably in driving revenue growth and played a crucial role in Pinduoduo’s rapid development.

As of September last year, Temu’s average daily shipment volume had reached up to 1.6 million packages, and this number continues to grow at a rate of 100,000 to 200,000 packages per month. This trend indicates that Temu has excelled exceptionally well in the field of CBEC, and will keep on providing a strong catalyst for Pinduoduo’s development.

Why Pinduoduo and its Temu grew like they were at the speed of light? In this case, we can undoubtedly say that the secret to Pinduoduo’s success lies in its significant price advantages.

Compared with another CBEC giant Amazon, Temu has demonstrated powerful competitiveness in good prices, with many of its items on sale priced way less than Amazon.

Everyone has to recognize that Temu is in sharp contrast with Amazon, and SHEIN, another CBEC platform that is also focused on low pricing, in terms of product prices and categories, providing consumers with more value and choices. Temu has successfully stood out in the highly competitive worldwide eCommerce market through precise differentiated pricing strategies, which not only reflects its core competitive advantages, but also actively promotes changes in the realm of CBEC.

Under Temu’s leadership, other platforms, channels, brands & retailers within the industry have taken their initiative to carry out their own “sinking strategies”, and cost-effective goods have progressively become the mainstream of the market. Even Amazon, which has always maintained a calm attitude, has to take action and join the low-price competition.

“卷”, or the involution in prices, has obviously become a prominent feature of the CBEC industry in 2024. Subject to inflation, consumers’ purchasing power has generally declined and they have become more price-sensitive. This makes the expansion of sales platforms and channels to lower-level markets an inevitable trend in future development. This trend not only meets the needs of consumers, but also injects new vitality into the market, and is unquestionably to become the mainstream trend in the CBEC industry this year. Therefore, if CBEC platforms, channels, or involved brands and retailers want to take advantage of the market competition, they must conduct refined adjustments, operations, and management of target markets and prices.

2. Revolution of Logistics Timeliness

One notable trend that deserves attention is the fierce rivalry in logistics timeliness among Chinese CBEC platforms.

In China, domestic next-day and half-day delivery services have gained widespread popularity, driving CBEC platforms to optimize their delivery timeliness little by little. In response to market demands, SHEIN has implemented a range of effective strategies, including the establishment of large-scale distribution centers worldwide and the digitization of its logistics system. These approaches have significantly enhanced delivery efficiency, enabling SHEIN to achieve an impressive average daily shipment volume of 1.1 million pcs and deliver packages globally within just 7 days. Such efficient delivery services not only improve the overall consumer experience but also contribute to the rapid development of SHEIN’s business.

Similarly, Temu has successfully reduced the delivery time from China to the US to an impressive 7-8 days, showcasing their commitment to improving timeliness.

Furthermore, the collaboration between AliExpress and Cainiao International is a crucial aspect that cannot be overlooked. Towards the end of the previous year, these two entities jointly launched the “Five-WD Global Delivery” international express service, which became the first to cover countries such as the UK, Spain, Netherlands, Belgium, and South Korea, projected from payment to delivery is 30% faster than the industry average.

3. The Accelerated Rise of Emerging eCommerce Markets

Aiming for the accelerated rise of the emerging eCommerce markets is the 3rd trend for the Chinese eCommerce industry.

Generally speaking, once a market is saturated, capital and businesses will tend to look for new markets, thereby exploring new business opportunities and growth space.

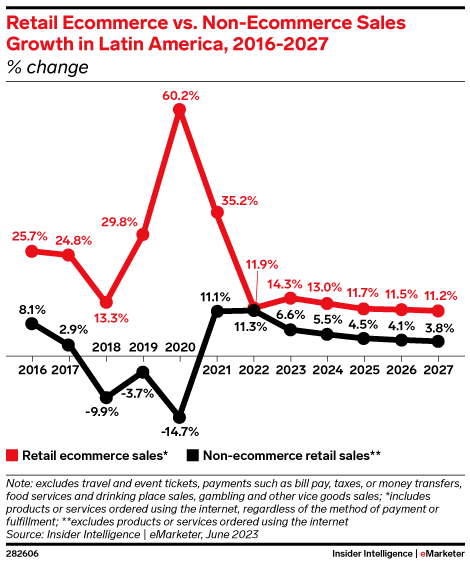

Taking the Latin American market as an example, eCommerce sales in this region have increased by 14.3% in the last year compared with 2022, and are expected to exceed the $200 billion mark by 2026. Therefore, when looking for new growth opportunities in saturated markets, these emerging markets may become important directions.

In addition, among the top 10 countries with retail eCommerce sales growth in 2023, countries such as Indonesia, Brazil, Vietnam, Argentina, Malaysia, Mexico, and Thailand performed healthily. The eCommerce penetration rate in these emerging markets is relatively low, but their growth rate is very speedy and consumer demands are surging.

These emerging markets are viewed as untapped “gold mines” of enormous value. Because of this, China’s overseas eCommerce platforms such as Temu, SHEIN, Douyin(aka Chinese Tiktok) Global and AliExpress are strategically targeting these emerging markets, aiming to capitalize on the abundant growth opportunities they offer.

What's Next for the Chinese CBEC Market?

In the foreseeable future, China will persistently address the challenges and obstacles associated with the supervision of CBEC. This commitment will drive continuous innovation in systems, management, and services, ultimately propelling the high-quality development of CBEC. By doing so, China aims to enhance the experience of both domestic and overseas consumers, producers, brands, and retailers, ensuring they have access to an ever-expanding range of superior goods and services. Through these endeavors, China remains dedicated to fostering an environment where the pursuit of excellence and customer satisfaction is at the forefront of CBEC operations.

If you want to learn more about Chinese Cross-Border eCommerce, or you’re a brand owner, a retailer, or just struggling to navigate the Chinese eCommerce market, please feel free to leave your comment and get our free consultation!

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

مرحبًا، أعتقد أن هذه مدونة ممتازة. لقد عثرت عليها بالصدفة ;

Great post. I will be dealing with some of these issues as well..

Attractive section of content. I just stumbled upon your weblog and in accession capital to assert that I get in fact enjoyed account your blog posts. Any way I will be subscribing to your augment and even I achievement you access consistently quickly.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.