Cosmetics enhance people’s appearance and inner confidence, providing a sense of beauty. They cater to human needs in terms of physiology, psychology, and society, enhancing physical and mental well-being and improving quality of life. This industry encompasses skincare, perfume, beauty apparatus, etc. With China’s thriving economy and rising consumer spending power, the cosmetics industry has experienced rapid growth.

In the vast landscape of the global beauty industry, few markets have experienced as remarkable a transformation as China. With its rapidly growing middle class and evolving beauty standards, China has become a substantial force in the cosmetics sector. However, the seamless integration of eCommerce has truly unleashed cosmetics brilliance within this thriving market.

The Market Size of Cosmetics in China

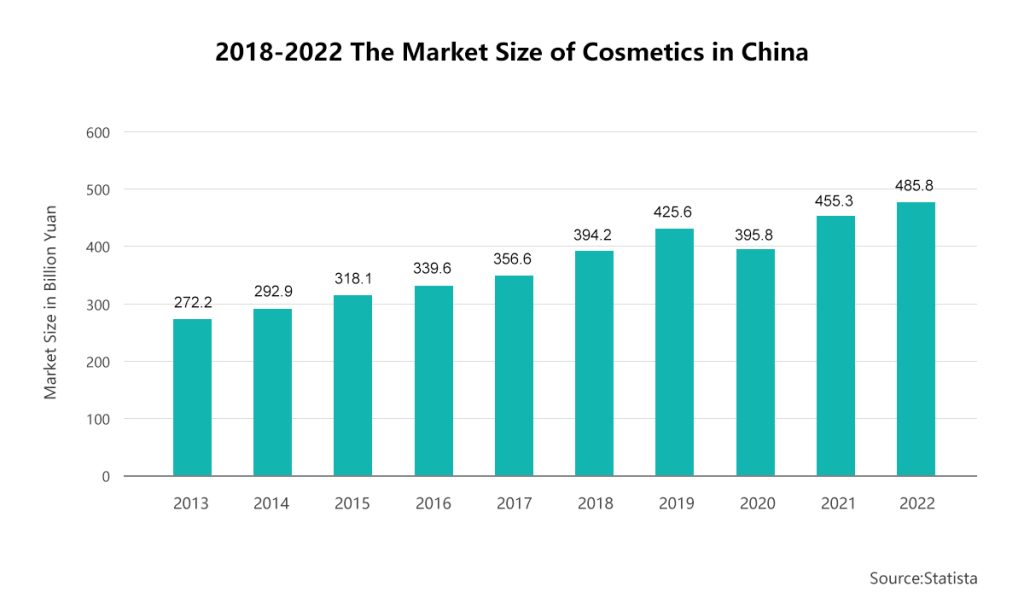

From 2018 to 2022, the national economy in China has witnessed steady development. As a result, there has been a continuous increase in per capita disposable income and consumer confidence among residents. This economic growth has led to more diverse consumer demands. With basic needs such as food, clothing, housing, and transportation achieved, people are now shifting their focus toward consumption related to body shape and appearance modification.

Seizing the opportunity presented by rising disposable incomes and the improved purchasing power of residents, the beauty industry in China has experienced significant growth. According to Statista, in 2021 alone, the cosmetics market size reached an impressive ¥455.3 billion – an increase from approximately ¥395.8 billion in the previous year.

Although impacted by the Covid-19 pandemic resulting in a decline in 2020—the first drop observed in nearly a decade—China’s cosmetics market has shown resilience and is on track for recovery. It is projected that at the end of this year, 2023, this vibrant market will reach an estimated value of around ¥516.9 billion.

Throughout the world, as of last year in 2022, the United States remained the largest consumer of cosmetics, comprising approximately 20% of the global market share. Meanwhile, China has emerged as the second-largest consumer, with a market share of around 17%.

Brief Overview of China Cosmetics Import

Due to its relatively late start, China’s cosmetics industry is still in the early stages of development. The industry exhibits primary growth levels, with enterprises yet to achieve significant comprehensive strength. As a result, those factors such as quality standards, brand recognition, and added value are not currently at their highest potential within the market.

Despite concerns about the macro-economy, specifically regarding rumors of China’s foreign trade difficulties, there are positive indicators in the cosmetics industry. The recovery of consumption and growing demand for cosmetics have led to an optimistic outlook for China’s beauty market in 2023.

From 2015 to 2022, there has been a consistent increase in import volume within China’s cosmetics industry. Based on Customs data, the imports reached $20.287 billion in 2021 – a significant year-on-year growth rate of 17.07%. This trend continued with imports amounting to $16.8 billion in 2022.

Furthermore, excluding a minor decline observed in the average import price of cosmetics during 2018, there has been a steady increase over recent years. In particular, the average import price per unit reached approximately $3.67 by the end of 2021 – a remarkable surge compared to 2021 at around a 10.21% growth rate and reached up to $4.11 per piece for 2022.

Images for Chinese Cosmetics Consumers

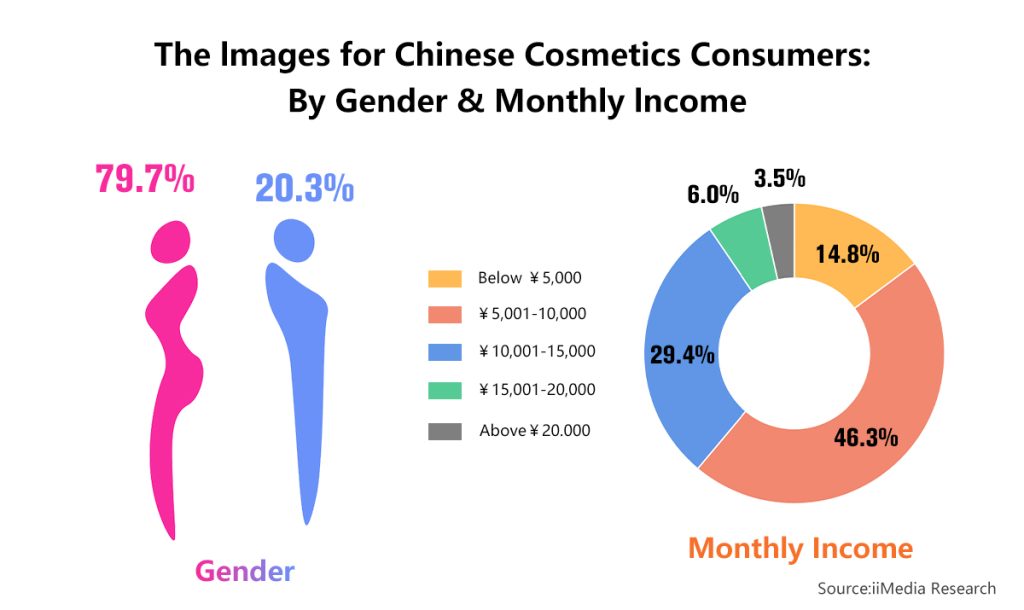

Gender & Income

The trendy beauty makeup market in China exhibits a relatively high proportion of female consumers, constituting 79.7% of the total consumer base.

Furthermore, there is a significant representation of middle and high-income groups among these consumers. The majority (46.3%) have a monthly income ranging from ¥5,001 to 10,000, followed by those earning between ¥10,001 and 15,000 (29.4%), while individuals with an income below ¥5,000 account for approximately 14.8%.

Age, GenZs & COVID

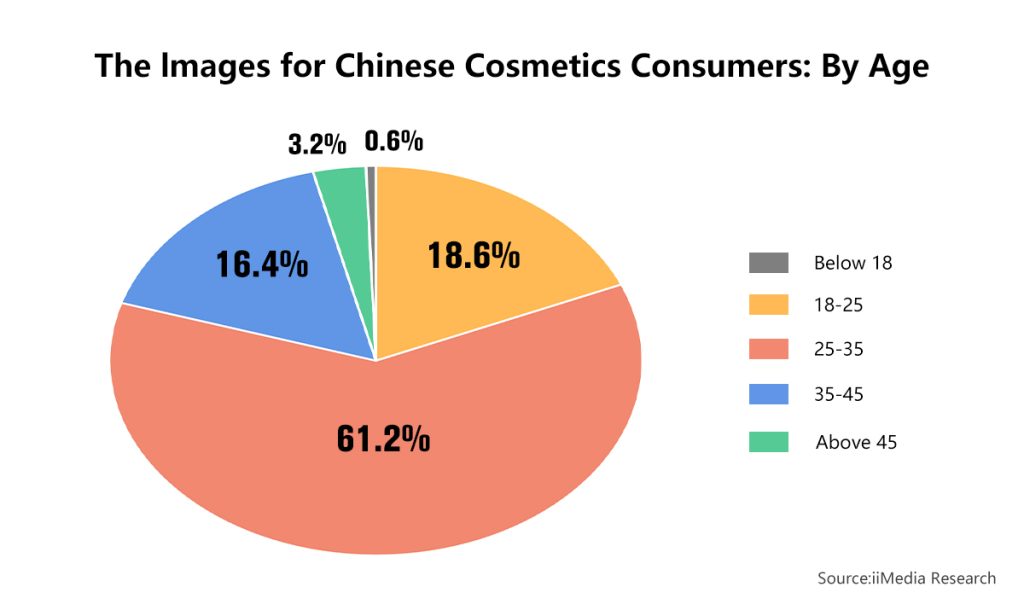

The age group that shows the utmost interest in this trend is concentrated within the 25-35 years old bracket, accounting for 61.2% of consumers, and those between 18-25 years old also occupied 18.6% of the market, indicating a clear preference for rejuvenation.

Throughout 2022, GenZs, born between 1995-2005, emerged as the largest consumer group in the beauty industry, displaying a particular inclination towards skincare compared to other demographics. Additionally, the male segment in China has experienced rapid growth, surpassing the global average. Retail sales for male beauty products have been increasing at an annual rate of 13.5% from 2016 to 2019, while the global average stands at 5.8%. In terms of market value, the male beauty market in China reached approximately $1.44 billion in 2021.

The impact of Covid-19 on the beauty industry varied across different product categories. Cosmetics faced more formidable challenges during this period while skincare and personal care products gained popularity. In August 2022, facial masks, skincare sets, serums, lotions/creams, and beauty apparatus were among the top 5 categories with high sales volume on the Douyin (aka Chinese Tiktok) platform.

Products that focus on skin repair, basic skincare, and “first-aid” care witnessed increased demand due to the prolonged use of face masks, causing possible damage to some people’s skin health. Interestingly, GenZs consumers displayed a strong interest in eye essence, eye cream, and face masks compared to other age groups. These types of beauty and skincare products also hold significant psychological value for them.

Cosmetics & eCommerce

In China, the eCommerce landscape is experiencing an unprecedented boom, with remarkable growth and opportunities. The cosmetics market specifically holds great promise within this thriving digital ecosystem. As more consumers embrace social media platforms and online shopping, Chinese eCommerce platforms have become popular destinations for purchasing beauty products. With increasing disposable incomes, evolving consumer preferences, and technological advancements, the cosmetics market in China is poised for significant expansion. Brands leverage this momentum to reach a vast consumer base and tap into their growing appetite for beauty products through innovative marketing strategies and seamless online shopping experiences.

Skin Care

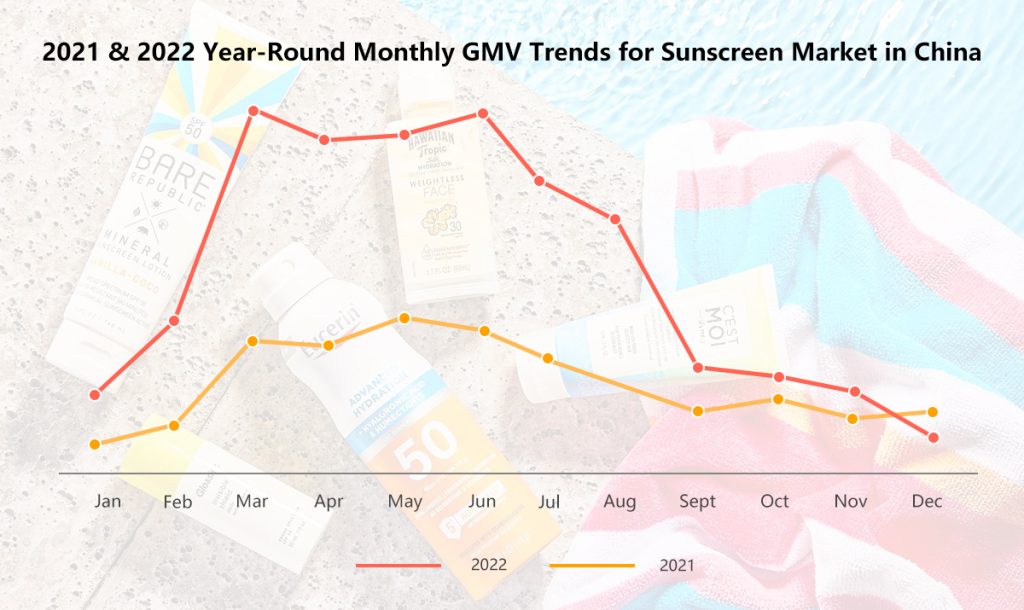

Within the skincare product category, there has been a notable increase in demand for sunscreen products, particularly among users seeking high-end options. This segment presents significant potential and serves as a catalyst for innovation and generating substantial customer orders.

When Chinese consumers purchase sunscreen products, their search preferences highlight an interest in the skin-modifying effects and long-lasting durability of these products. The overall user experience places considerable emphasis on the price range of sunscreen products available in the market. Competitively priced options are concentrated within ¥200, leading to intense competition within this range. Conversely, higher-priced products above ¥200 are relatively scarce but experiencing rapid growth, making it a profitable market to explore.

The demand for sunscreen products exhibits distinct seasonality trends, with significantly higher sales during spring and summer compared to other seasons. The peak sales period for sunscreen typically spans from March to June each year in China.

Facial Beauty Devices

The variation in efficacy plays a crucial role in determining the differentiation among brands and prices of facial beauty apparatus. In 2021, product prices for facial beauty equipment were primarily concentrated within the range of those below ¥500 and above ¥4,000. In the previous year of 2022, the increase in products available across different price segments as Chinese consumers’ demand for facial beauty equipment, especially facial massagers, continued to rise. A comparison between products from various price ranges over the past two years reveals that facial beauty equipment priced below ¥2,000 tends to focus on functions such as cleansing and auxiliary absorption. On the other hand, products with facial lifting and firming effects are generally priced above ¥2,000.

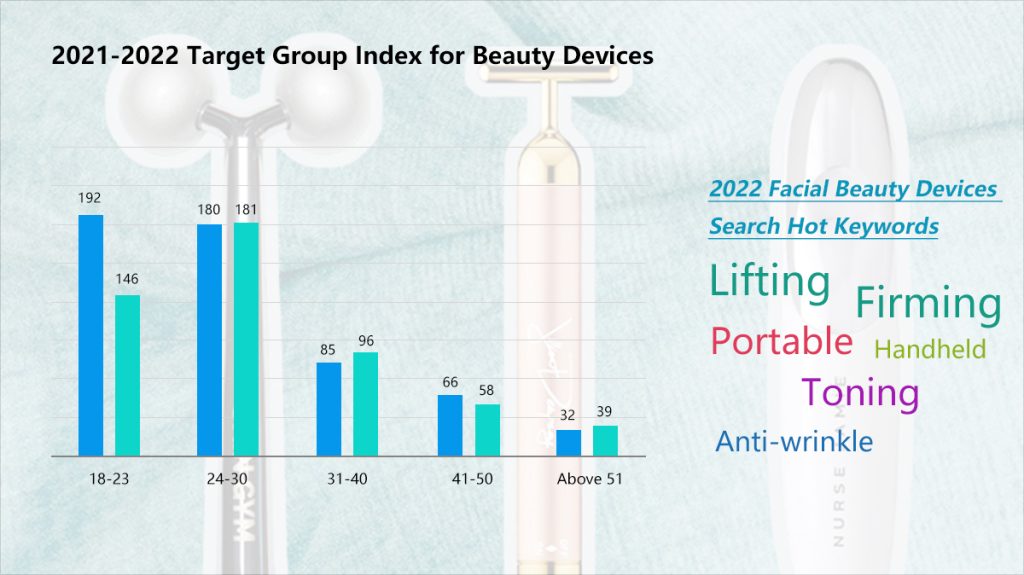

Data indicates that the TGI (Target Group Index) for beauty devices is higher among individuals aged between 18-23 and 24-30 – both age groups showing greater interest in these devices. Judging by popular search keywords, consumers prefer to choose facial beauty devices with functions related to facial lifting, firming, toning, and anti-wrinkle properties. Additionally, handheld and portable features are considerations that consumers pay closer attention to.

Makeup & Perfume

The makeup and perfume industry primarily features hot-selling categories with unit prices concentrated below ¥100, and products falling in the price range of ¥10-200 contribute significantly to overall sales. However, there remains untapped potential for market share growth in high-end product lines.

Base makeup and lip makeup serve as the leading consumer markets. These products are sought after by consumers for their ability to even out skin tone and enhance complexion, catering to daily makeup needs. As consumers increasingly seek refined makeup looks, advanced cosmetics subdivision products such as silkworm pens have experienced an impressive growth rate of 1836.87%. Similarly, lip pencils/lip liners have witnessed a substantial growth rate of 1664.76%.

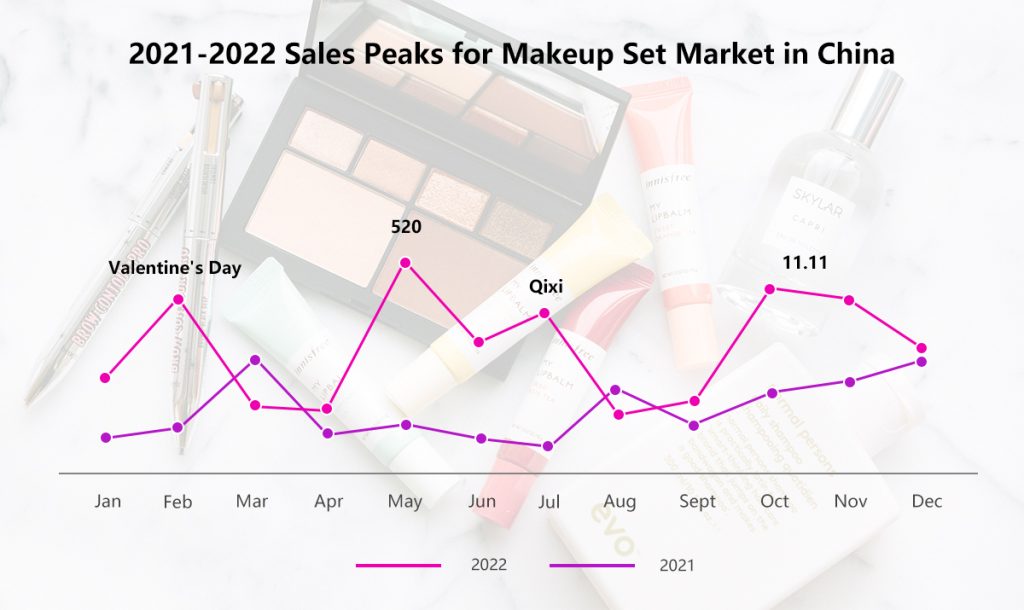

Makeup sets have emerged as a strategic approach for merchants aiming to increase consumer spending per purchase. In 2022, the GMV (Gross Merchandise Volume) of the makeup set market enlarged by 125.5%, while the market share of TOP5 brands increased by 24.67%. Sales within the year usually reach their peaks on the following specific timing: Valentine’s Day, which is driven by solid demand during gift-giving occasions like Valentine’s Day itself, “520” (May 20th, in Chinese, it sounds like “I love you”), and Qixi Festival (Chinese Traditional Valentine’s Day). Besides, the Double Eleven Shopping Festival (on Nov. 11th) also serves as an opportunity for brands to promote their offerings through attractive discounts and curated product combinations.

Regarding perfumes, notable shifts in the Chinese market include a growing emphasis on natural ingredients and heightened recognition of the emotional and psychological benefits of fragrances. Floral, citrusy, and woodsy scents reign supreme among Chinese consumers who appreciate these aromatic profiles.

Furthermore, GenZs significantly influence China’s fragrance market transformation despite relatively low perfume penetration nationwide. This demographic is anticipated to drive increased demand for niche fragrances due mainly to social media platforms’ pivotal role in boosting sales rates.

The Future Trends of Cosmetics Market in China

Digitalization

In today’s cosmetics industry, establishing a robust online presence on social media platforms in China is paramount for brands to succeed. Chinese consumers have shown a strong affinity for technology and personalized recommendations, making it crucial for beauty companies to invest in eCommerce solutions and at-home beauty devices. The rise of the “lazy economy” trend and the emergence of GenZs as an influential consumer group further emphasize the importance of catering to convenience-driven preferences.

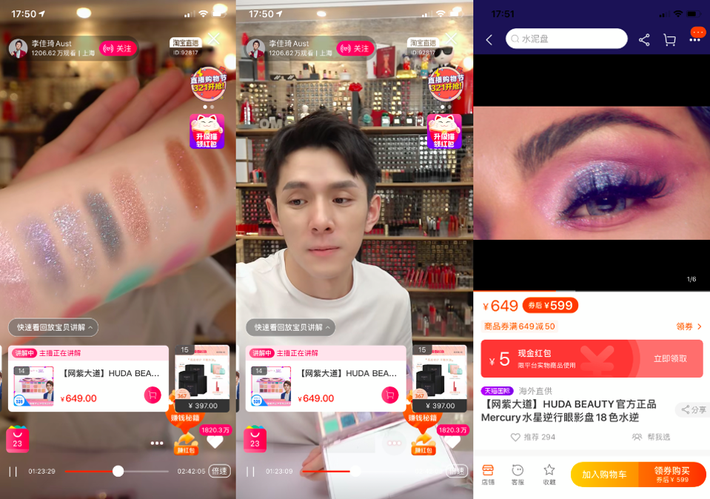

The Covid-19 pandemic has profoundly impacted consumer behavior, prompting more individuals to seek entertainment and shop through social media platforms. This shift highlights the growing significance of incorporating livestreams and KOLs into beauty brands’ marketing strategies. Leveraging these channels allows brands to connect with their target audience and enhance brand awareness effectively.

By capitalizing on technology-driven solutions, embracing eCommerce platforms, exploiting at-home beauty apparatus, and utilizing influential voices within social media spaces, beauty brands can adapt to evolving consumer behaviors while staying competitive in this dynamic market.

“She Economy” & Skin Care for Babies

The “She Economy” has reached a level of maturity while still holding immense promise for the future. Mature women, particularly those aged 30-49, have displayed significant growth in demand for makeup over the past four years. This age group is also more likely to change brand preferences and awareness. Women above the age of 40 typically possess knowledge about three brands that can potentially translate into actual purchases. Social media platforms like Douyin, which boast a large user base of young individuals, present an opportunity to tap into what can be termed a “filial piety economy.”

As the “She Economy” continues to develop, it also influences the market for baby-oriented products. Baby skin is exceptionally delicate, making repair-focused products highly sought after. Facial skincare, buttock care, and sunscreen are vital categories catering to this repairing effect. Sunscreen products experience strong sales during spring and summer when young parents begin paying attention to their babies’ sun protection needs while traveling.

When weather changes lead to dryness and chapping of baby’s skin in the autumn and winter, facial skincare and buttock care products gain popularity. These unique function-driven products with clear goals remain valuable and necessary within this market segment.

Overall, understanding these dynamics allows businesses to capitalize on opportunities presented by mature women in the “She Economy” while simultaneously addressing the specific needs of baby-oriented product markets.

A Promising Market

As China’s economy continues to grow and residents’ incomes improve, there is a corresponding increase in market demand for cosmetics. Consequently, the overall size of China’s cosmetics industry is expanding. It is projected that at the end of 2023, the industry will undergo further scale expansion, refinement improvement, and industrial upgrading. This growth will be characterized by steady and orderly development as well as innovative changes in the development model.

In the future, driven by the desire for instant beauty solutions and a strong emphasis on individuality, China’s cosmetics consumption market is expected to experience rapid growth. Brands entering the Chinese cosmetics industry must focus on product fundamentals. The critical factors for sustainable and healthy development lie in brand direction, product quality, efficacy, and marketing innovation.

To thrive in this dynamic market landscape while meeting consumer demands effectively requires brands to prioritize these essential elements. By focusing on delivering high-quality products with proven efficacy through innovative marketing strategies aligned with evolving consumer preferences towards instant beauty and personalization trends – brands can position themselves for long-term success.

In conclusion, if you want to expand your presence in the thriving cosmetics market of China, SENCENT is here to assist you. With our expertise and resources, we can help facilitate the process of exporting your products and establishing a solid foothold in this lucrative market.

Take advantage of the incredible opportunities that await! Contact us now to begin your journey toward success in China’s cosmetics industry. And together, let’s unlock new possibilities and make your brand shine in the vibrant beauty landscape of China!