On November 24th, the merchant service hall on Taobao’s web page showed that Taobao’s Double 12 event will no longer be held this year, and will be replaced by the “Taobao Year-End Good Price Festival”, which has begun attracting investment at the end of November.

The “Taobao Year-end Good Price Festival” event time is specifically from December 8th to 12th, and Taobao & Tmall will participate in the event together.

It is worth noting that last year’s Taobao Double 12 event was also held from December 8th to 12th.

Changing the name is actually a more honorable way to quit.

“Double 12”, a major eCommerce shopping carnival that has been held for 10 consecutive years, eventually said goodbye.

What was “Double 12”?

Double 12, as the name suggests, is a shopping carnival held by major Chinese eCommerce platforms on December 12th every year. All platforms will gather brands and individual sellers from various fields with diverse types of products, including clothing, maternal and infant, necessities, 3C (Computer, Communication, and Consumer Electronics), cosmetics, and other categories. During the event, millions of “red pockets” that can be used for deductions are sent to consumers as a form of discount & coupon. Various platform preferential policies also accompany the end-of-year giveback gift.

As an important festival in the realm of Chinese eCommerce, Double 12 has attracted the attention of many consumers and merchants through years of accumulation. However, in recent years, the scale and influence of Double 12 have not just gradually weakened, but sharply slashed – Ali has not announced the transaction volume of the Double 12 event for many years in a row, and many online shopping lovers have even accused the event itself of being “tasteless.”

Deeper Reasons for the Cancellation

1. Increased Peer Competition

With the rapid development of the Chinese eCommerce industry, competitive pressure is gradually increasing. All leading eCommerce platforms, not only Taobao, Tmall, JD.com, but also Douyin, RED, Pinduoduo, and WeChat Mini-Program, are working hard to build their brands and features to attract more consumers. Although Taobao Double 12 once had high visibility and influence, in recent years, other emerging platforms have been actively carrying out similar and even more powerful promotional events without specific time limits, making Taobao’s Double 12 advantages gradually disappear.

2. Changes in Consumer Demand

As Chinese consumer needs continue to change, their requirements for shopping experience are also getting higher and higher. Traditional eCommerce platforms and modes can no longer meet all the needs of consumers, who need more convenient and personalized shopping methods (e.g., livestreams, KOL & KOC promotions). Therefore, large-scale and centralized promotional events such as Taobao’s Double 12 have progressively lost their appeal.

3. Merchant Quality Varies

Although Taobao Double 12 and some other platform promotion events have attracted the participation of many merchants, there are also some merchants of varying quality. Some unscrupulous merchants obtain profits through false advertising, fraud and other means, seriously damaging consumers’ interests. In order to solve this problem, Taobao has increased the review and management of merchants, but the effect is not ideal.

Impacts of the Cancellation

The cancellation of Taobao’s Double 12 event has undoubtedly had a significant impact on the platform itself. This festival held great importance for Taobao, as it traditionally brought in high traffic levels and generated substantial transaction volume. However, with its cancellation, the platform now inevitably faces the risk of losing this influx of traffic and transactions to competing eCommerce platforms or offline channels. Consequently, Alibaba, the parent company of Taobao, has to reassess its brand strategies and platform features to attract more consumers and merchants. It becomes crucial for them to strengthen services and guarantees for both merchants and consumers, aiming to enhance competitiveness and improve the overall user experience.

Moreover, cancellation has also exerted a notable influence on traditional eCommerce platforms. One of the most typical examples is that Taobao has long grappled with issues such as convoluted shopping processes and sluggish logistics. These limitations have hindered their growth and progress in the industry. With the event’s cancellation, traditional eCommerce platforms must thoroughly examine their existing challenges and proactively implement measures to address them. Failure to do so would result in these platforms falling further behind the evolving demands of the market, losing market share, and potentially seeing a decline in their user base.

Rise of the New eCommerce

Compared with traditional eCommerce, new eCommerce replaces the “search logic” with the “stimulation logic,” such as short video, livestream, social, and interest eCommerce mode.

In China, with the emergence and prosperity of “new segmented economic forms” such as the contactless, lazy, she, appearance, and age-friendly economy, the breakthrough innovation of the new generation of digital technology, and changes in consumer demand and behavior patterns, new eCommerce also reflects modern trends and characteristics such as a shift from traffic-driven to high-quality content and quality-driven.

New eCommerce continues to expand in scale due to its strong development, tenacity, and vitality. Taking the most representative livestream eCommerce as an example, in 2022, it accounted for about 23% of the whole eCommerce retail sales in China, reaching ¥3.5 trillion, with a year-on-year increase of 48.21%. And this year, 2023, it will even exceed ¥4.9 trillion, and the number of eCommerce livestream audience is approximately 526 million, accounting for 48.8% of the total Chinese Internet users.

Creating and leading the new eCommerce modes in China, Douyin and RED play as two outstanding platforms.

Douyin (aka. Chinese Tiktok)

As the explorer, the pioneer, and the leader of the new Chinese eCommerce mode, the core operating mode of Douyin eCommerce is to display products, and allow the audience to place orders amid the livestreams and short videos. In this form, consumers can not only see the physical display of the product, but also learn more information through interactive communication, thus enhancing their trust in the product and desire to purchase.

Douyin eCommerce has a wide range of products, including mass consumer goods such as clothing, beauty products, and digital products, as well as specialty agricultural products such as planting and agricultural and sideline products. Therefore, Douyin eCommerce gains large user base and market demand, providing more opportunities for merchants.

The advantage of Douyin eCommerce lies in its social nature. Through livestreams and short videos, merchants can establish closer social relationships with the audience and shorten the distance between them. Consumers can casually interact with merchants, ask questions, and make suggestions. In this interaction, consumers can feel the concern and attention of merchants to users, thus forming a more stable consumption relationship.

The new eCommerce mode has brought rapid growth to Douyin. In the past year, Douyin’s eCommerce GMV has increased by more than 80% – among which, the mall’s GMV has elevated by 277% year-on-year, and the eCommerce search GMV has risen by 159% year-on-year.

RED (aka. Xiaohongshu, Little Red Book)

90%+ of the users on the RED platform are female, well-educated, ready-to-buy, and keen on exploring new stuff.

As a content-based community, RED has successfully amassed numerous high-quality KOLs (Key Opinion Leaders) and KOCs (Key Opinion Consumers). By disseminating of top-notch content, commonly called “种草” or “Recommendation,” it effectively guides users in making purchase decisions.

The new eCommerce mode on RED involves the top KOLs creating momentum, KOCs providing word-of-mouth feedback and dissemination, and brands implementing layered advertising and promotion. This mode leverages note recommending to promote the brand or products, subsequently increasing investment and realizing rapid sales growth.

The unique “buyer mode” on RED proves to be highly effective and ideal. RED serves as a trading platform, while merchants are responsible for contract fulfillment and after-sales service, content creators publish informative notes, and users browse these notes and place orders.

Dedicated to serving 3rd-party sellers and KOLs and focusing on the new eCommerce mode of the “Buyer Mode,” RED has achieved a 27-fold increase in the number of eCommerce buyers and brand owners in the past year and a half, and the number of merchants has increased 10 times, and the number of purchasing users increased 12 times.

The advent of the new eCommerce mode has ushered in a transformative era of consumption upgrades. By expanding consumer categories, meeting individual needs, enriching consumption scenarios, and boosting Chinese income, this mode has reshaped the way Chinese shop and engage with commerce. With its profound impact on the economy and consumer landscape, the new eCommerce model stands as a testament to the power of innovation and adaptation in driving a more personalized and fulfilling consumer experience.

“Double 12” was Abandoned, What’s next?

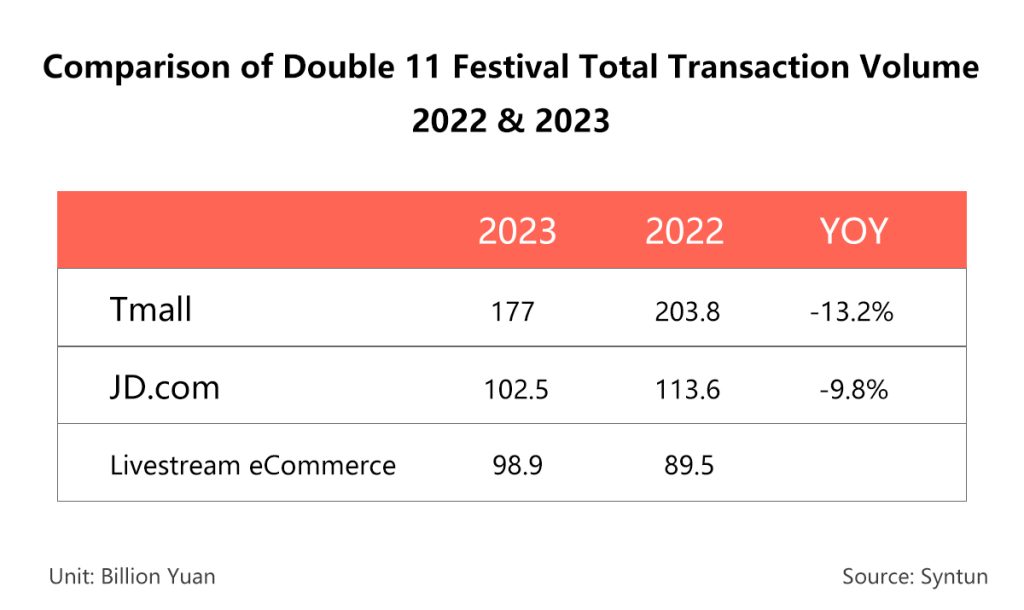

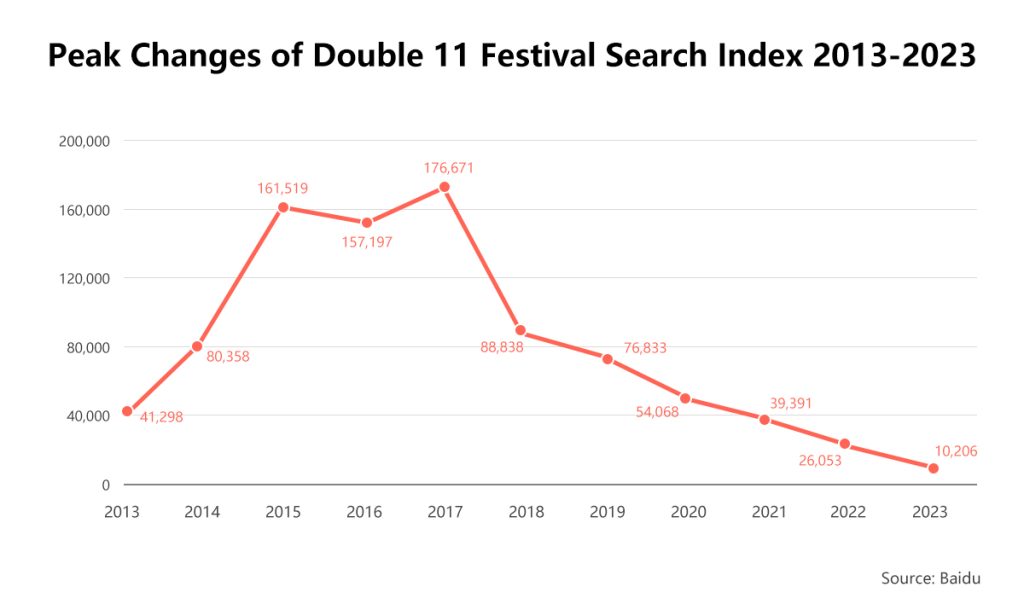

Not long after Double 11, traditional eCommerce platforms, especially Ali’s Taobao & Tmall, successively announced the total transaction volume during the event – ¥177 billion, while the sales of last year’s Double 11 was ¥203.8 billion, showing a 13.2% decrease. This year’s Double 11 performance of traditional eCommerce platforms was almost at a “freezing point.” The transaction volume drop sharply, and the search volume dropped by approximately 60%.

The dismal record of the Double 11 will inevitably implicate the Double 12.

Ten consecutive years of Double 12, finally disappear from our online shopping lives. It is still unknown whether Double 11 will continue to be held next year.

Is it just a simple cancellation announcement, or is it actually claiming that platforms that still run traditional eCommerce mode need to shift?

The shift from traditional eCommerce modes to new eCommerce modes is driven by changing consumer expectations, the rise of mobile commerce, the need for enhanced personalization, omnichannel integration, the influence of social commerce and KOLs & KOCs, technological advancements, and the desire for global market access. Integrate with social media, embrace livestream and short video commerce, making eCommerce platforms stay competitive, meet consumers’ ever-changing demands, and provide exceptional shopping experiences in the digital age.

Contact Us!

If you want to learn more about the Chinese eCommerce, Or be interested in our services for you to export to China... Please Feel Free to Communicate with Us!