Before talking about nuts, let’s begin with snacks.

What are snacks? Snacks refer to a category other than regular meals, with weak demand for satisfying hunger, emphasizing consumption scenarios, meeting more dimensional needs (including emphasizing health and more functional extensions, incorporating more emotional value), a single product or multi-category creative fusion, Ready-to-eat foods that can be sold loosely.

From the business perspective, snack is a fast-moving consumer good, and it is the food people eat when they are free and resting. Snacks are promoted gradually to become normal people’s daily essential consumer goods. With the rising of the expanding economy and the level of consumption, the consumer constantly increases the demand for snacks’ quantity and quality. The snack industry’s essence is realized by industrial upgrading under the background of uprising consumer demand. Non-essential consumer goods are impulsive purchases, satisfying diverse needs such as leisure enjoyment, emotional communication, and health.

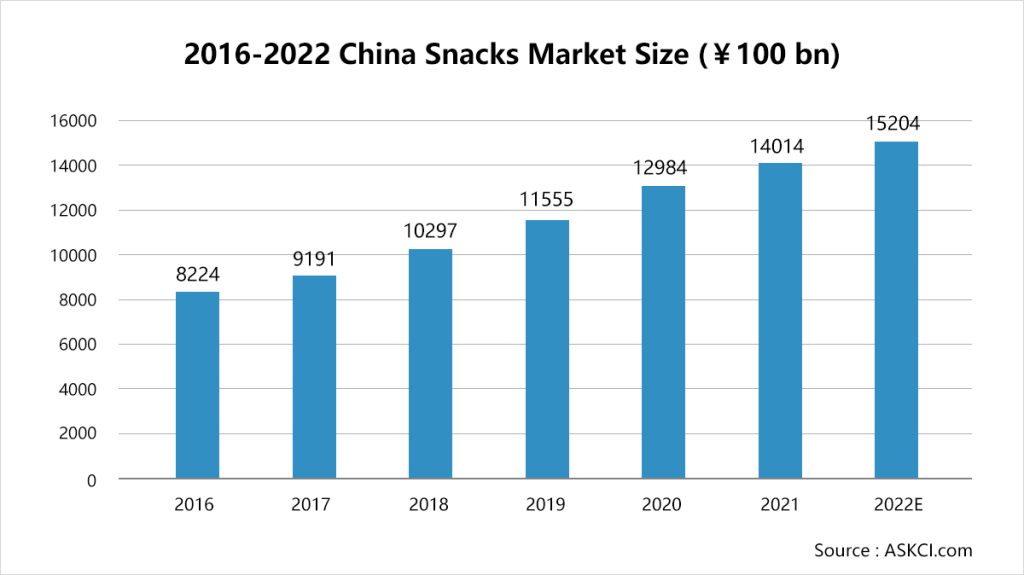

According to ASKCI, the scale of China’s snack food market has exceeded one trillion yuan, with a compound annual growth rate of more than 10% in the past five years. The COVID-19 epidemic in 2020 had a short-term impact on the snack food industry, causing the market’s growth rate to slow down slightly compared with previous years. But on the other side, it has also promoted the development of the snack industry in emerging channels such as livestreams and community group buying. In 2021, the scale growth rate of the industry rebounded, maintaining a long-term and stable growth trend. In 2020, the scale of the snack market was close to 1.3 trillion yuan, and in 2021 it exceeded 1.4 trillion yuan. The snack market is expanding steadily and has a vast space.

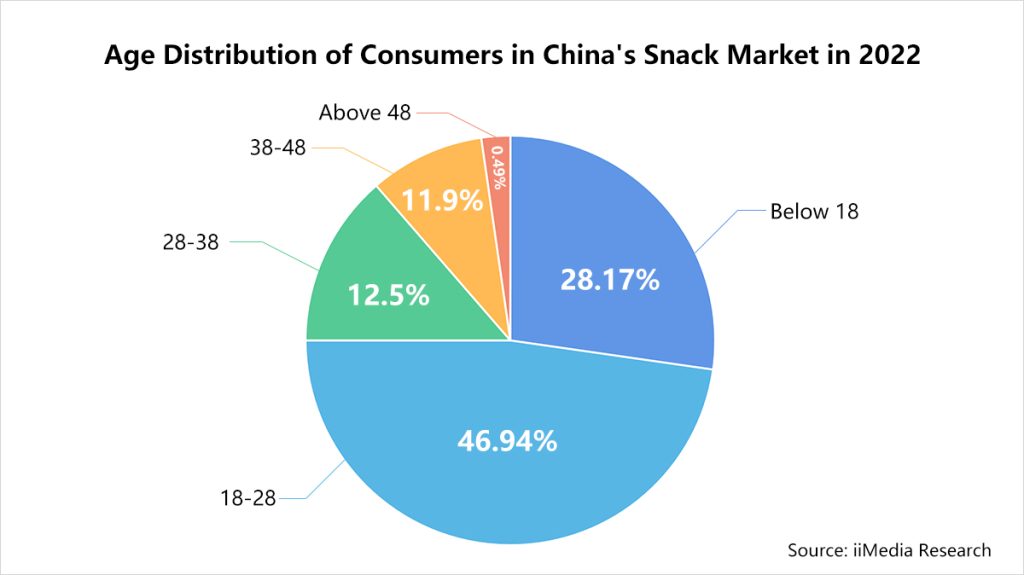

The structure of the consumer group in the snack food industry presents a more obvious feature-younger. Consumers aged 18-28 accounted for 46.94%, consumers under 18 accounted for 28.17%, consumers under 28 accounted for more than 75%, and the structure of consumer groups is relatively young. These young consumer groups grew up in a more inclusive and open social environment, forming a more independent personality with more subjective expressions and personalized consumption pursuits.

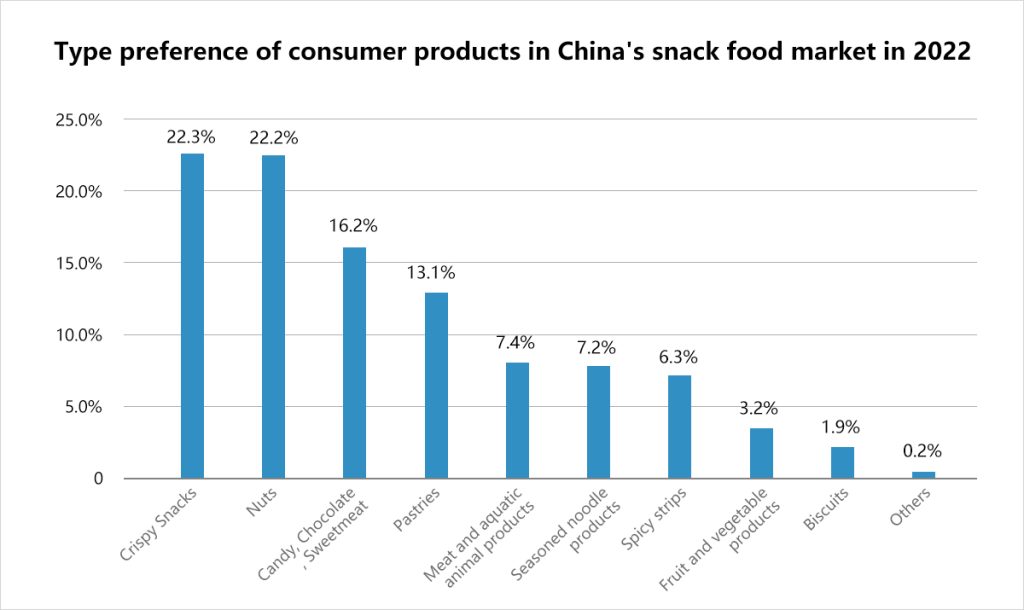

According to the feedback from the leading e-commerce platforms in 2022, crispy snacks(crispy noodles, potato chips, etc.) and nuts are the types of snacks that the Chinese like the most, accounting for 22.3% and 22.2%, respectively, and were followed by candy, chocolate and sweetmeat, accounting for 16.2%. In addition, pastries, meat and aquatic animal products, seasoned noodle products (spicy noodles, etc.), and spicy strips/sticks are also popular snacks, accounting for 13.1%, 7.4%, 7.2%, and 6.3%.

So, after you finish reading the stats above, you should already know and agree that we can describe China’s snack market as a paradise. As consumers constantly seek new snacks, overseas snack brands have become popular. Therefore, many more export opportunities for international brands to enter China’s snack market appear.

Any export suggestions for overseas snack brands to expand their sales to China? In the view that the crispy snack market is already oversaturated, so for the rest of the article, we will introduce you to all the things about the No.2 product on the list — Nuts and its market in China.

Overview of the Nuts Market in China

The Statista tells us that the revenue made by the nuts market in China amounted to $7.39 bn in 2022, and the market is expected to grow annually by 10.2% for the next few years. The growth rate of the online nut market will slow down in 2022, and new impetus is urgently needed to stimulate growth. However, nut products with high prices still show a strong growth trend. Among sub-categories, mixed nuts are the leading force in the market, and their sales account for 30% of the overall nut market. The market and growth rate of categories such as melon seeds, pine nuts and peanuts are stable, while a new niche product, small ginkgo, is growing rapidly.

Currently, China’s per capita consumption of nuts and dried fruits (Why talking about dried fruit? Because the mixed nut products are a combination of various nuts and dried fruits)is lower than that of developed countries such as the United States, Japan and even the world. According to relevant data, the average annual consumption of almonds, cashews, macadamia, pecans and walnuts is only 0.23 kg. During the same period, the average levels of the United States, Japan, and the world were 8 times, 2 times, and 2 times that of China.

In particular, the per capita consumption of cashew nuts, macadamia and pecans in China are about 0. Therefore, speculative consumer demand for nuts in China still has much growth potential. With the further improvement of domestic consumption capacity, the consumption penetration rate of high-end tree nuts has further declined, and the Chinese nut market still has a lot of place for growth.

Segmentation of Consumer Groups

Nut consumers are dominated by younger women, showing more substantial purchasing power. People with high energy needs, mainly children, prefer mixed nuts and pursue a balanced nutritional mix.

Most of the casual crowd are post-90s and singles, and they prefer nuts that are easy to eat or to peel, such as melon seeds, pistachios, and peanuts. Delicacy is the primary demand for nuts consumed by this group of people.

The gift-giving crowd is also a significant force that must address in the consumption of nuts. The Mid-Autumn Festival, November, and around the Spring Festival, days of traditional Chinese festivals are all outbreaks of nut gift-giving.

The Purpose of Chinese Consumers Purchasing Nuts

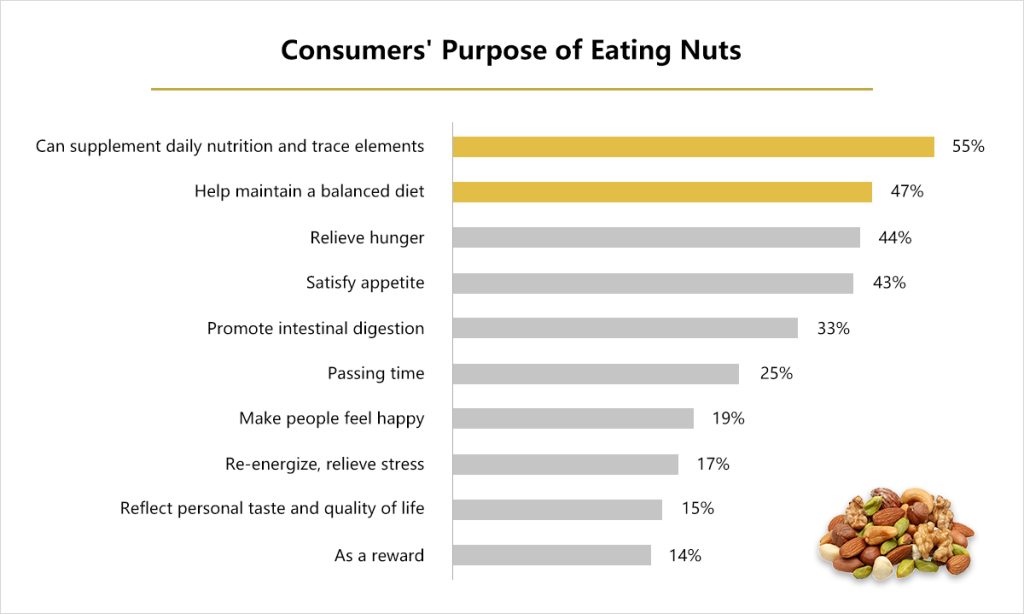

Why would people be keen on buying nuts? Feedback tells the answer — over half of the consumers say they targeted the nuts to supplement daily nutrition and trace elements.

“Keep healthy” continue to rise in consumer awareness, and overseas brands can use the concept of “Eating nuts makes healthy life” to better communicate with consumers. A significant amount of Chinese office workers are sacrificing proper meal times to adapt to fast lives, especially the Millennials and GenZs, who spend most of their days out of their homes, are eager for healthy snacks and looking forward to a healthier lifestyle, thus driving the demand for healthy snacks.

Still, many so-called unhealthy snack options are on the rise, and more people are aiming for daily nuts and dried vegetables or fruit, building up a considerable market share of these products.

Their growing purchasing power and changing eating preferences favor China’s nuts and dried vegetables/fruits market, and the trend will continue for years. Packaged mixed nuts or fruits are popular among Chinese consumers called Daily Nuts, with each package being one portion, which is suitable for a small meal between or during meetings, sports activities and more situations.

Meanwhile, consumers expect eating nuts can help to maintain a balanced diet, relieve hunger, and satisfy the appetite, and some people can even see eating nuts as a reward. These feedbacks also explain why Chinese consumers purchase nut products.

Tips for Nuts Brands to Win Consumers in the Chinese Market

"Stay Original"

As the market of nuts grows, consumers’ demand for “original flavor” has also significantly increased, exceeding the market supply. Chinese consumers believe that “original flavor” means that the quality of nut products is better, and the processing method can retain nutrition better.

Excavating the “original flavor” and matching it with multi-forms of sets is a new trend of high-speed growth of nut brands. Using nuts with yogurt or fruit as a light meal replacement has become a great advantage, while nut butter, nut with lotus root starch, nuts paired with wine, and nut stir-fry dishes are high-growth opportunity choices.

"High Quality"

Professionalism creates high-end quality, and strict selection of origin and selected raw materials are the quality assurance of nut brands. There are many producing areas of nuts. When consumers are picky about the producing regions, they actually pay more attention to whether the climate of the specific producing areas is suitable for the growth of nuts than the wide range of national sources. The integrity and size of nut particles are another major concern for consumers. In cashew nuts, pistachios, almonds and other categories, many brands have successfully seized the eyes of consumers with the size of nuts.

Anyways, various standards for nuts make it difficult for consumers to form a unified understanding. So, nuts brands still need continuous publicity and explanation.

"Brand Recognition"

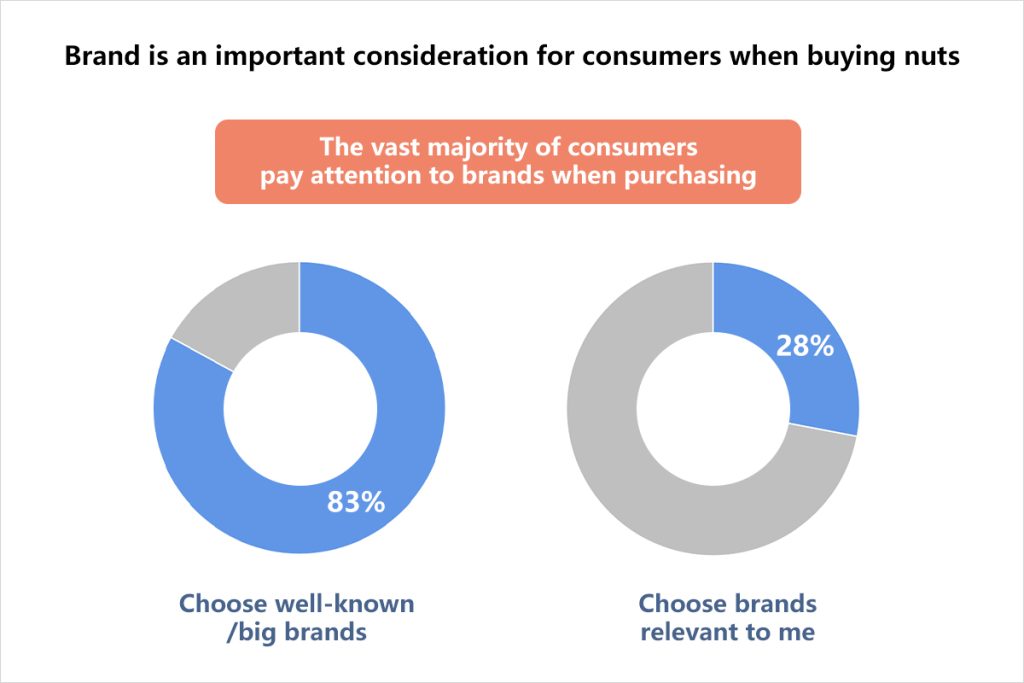

According to the e-commerce platform research and feedback, more than half of consumers said they would pay attention to brands when buying nuts, and 83% of consumers tended to choose well-known/big brands.

In addition to selecting the place of origin and providing high-quality products rich in functional nutrients to achieve product upgrades, the brand can also seize marketing opportunities such as “fancy baking” and “edible diversity” to maximize the unique “content” of nut brands. This “Power” enables the brand to increase the first promotion rate among a wider audience, highlighting its differentiation and relevance to consumers’ daily life so that they can immediately think of it when they want to buy.

How to Market Your Nuts Brand in China?

Nowadays, China is the world’s biggest e-commerce market. And as the market grows, more choices are showing up for overseas brands to enter China marketplace through cross-border e-commerce platforms, including but not limited to Douyin E-commerce, T-mall Global, RED (aka. Xiaohongshu), Wechat Mini-program, etc. Cross-border e-commerce platforms provide a vast stage for overseas brands to show themselves, attract consumers, and build positive brand images.

If your brand wants to sell your nut products or other snacks to China and occupy a place in China’s market or learn more about cross-border e-commerce, please don’t hesitate to Contact Us!