Mom and baby products encompass a range of specialized health items for pregnant women and babies aged 0-3. These segments have unique physiological and psychological needs, which demand exceptional standards when selecting suitable mom and baby products. Given their distinctive body shapes and requirements, the criteria for choosing such products are stringent and require careful consideration. The utmost precision is necessary to ensure that these professional health products meet the exacting demands of expecting mothers as well as infants in their crucial developmental stages.

In global commerce, few markets hold as much promise and potential as China’s thriving eCommerce landscape. The sector dedicated to mom and baby products stands out amidst this dynamic environment, offering remarkable opportunities for overseas brands seeking to establish their presence in this vast market. With an authoritative perspective and unwavering commitment to expertise, we explore the unparalleled possibilities awaiting international mom-and-baby brands in China’s eCommerce domain. Together, let’s see how overseas brands can seize success within China’s burgeoning sphere of mom-and-baby products through astute eCommerce strategies.

Overview of the Chinese Mom and Baby Market

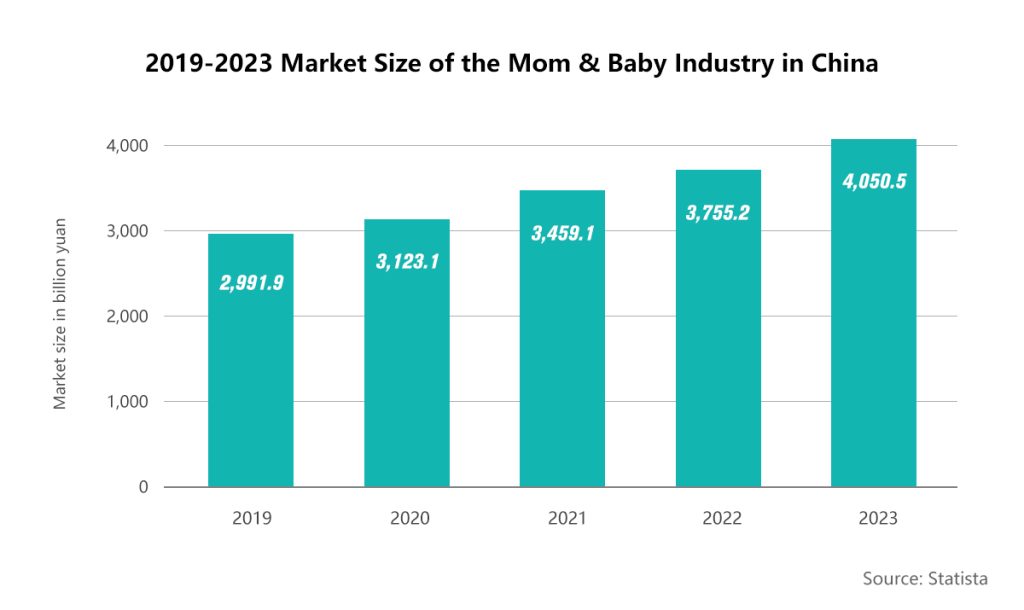

Mom and baby products form a significant portion of household consumption expenditure, encompassing various goods and services. In light of data from Statista, as of 2019, the market size for China’s mom and baby industry reached close to ¥3 trillion. Maternal and infant clothing, shoes, and hats accounted for approximately 26%, while toiletries made up around 6.9%.

Looking ahead, multiple factors such as the presence of over 490 million family groups in China, driving forces from various aspects, and a backdrop of consumption upgrades are expected to contribute to the flourishing growth of the mother and baby market in China. It is estimated that at the end of 2023, the scale of China’s maternal and baby market will surpass an impressive threshold of ¥4 trillion while maintaining stable growth rates in subsequent years.

In this era characterized by consumption upgrades, GenZ has emerged as a key demographic within the pregnancy population with their evolved concept towards parenthood. This generation is willing to invest in high-quality products and services catering to their specific needs during pregnancy journeys. Additionally, advancements in artificial intelligence technology along with cloud computing have provided robust technological infrastructure support for the mom and baby industry – further fueling its expansion trajectory.

Market Reveal: Facts & Current Situation in China

A few blunt words here: China’s maternity and baby industry is experiencing a transformative phase characterized by intensified competition, and stagnant or even negligible growth in sales, revenue, and profits. However, it is essential to note that this observation is not intended to discourage brand owners but serves as an honest assessment of the prevailing situation. The current situation undoubtedly emphasizes the reality that there’s no more easy money in this market nowadays. It underscores the necessity for both domestic and overseas brands to embrace professionalism and adopt a long-term perspective if they aspire to capture a significant market share. By acknowledging these facts and confronting the challenges head-on, brands can position themselves for sustained success amidst this evolving landscape.

In 2022, China witnessed a total birth population of 9.56 million, with a birth rate of 6.77‰ and a natural population growth rate of -0.60‰ – This marks the first instance of negative population growth in China after many years of continuous increase. To promote long-term balanced development, the Chinese Government issued policies allowing couples to have three children while removing various restrictions such as social support fees and punitive regulations, encouraging active childbearing.

The “three children” policy and supportive measures are expected to stimulate consumer demand and unlock consumption potential within the maternal and infant consumer goods industry. Consequently, this will significantly contribute to its development trajectory. Driven by technological advancements and evolving maternal and infant consumption preferences, it will surely to anticipate a rebound in the maternal and child consumer goods market.

As this industry continues to evolve, on & offline channels converge and integrate within the maternal and child consumer goods market. Technology plays a crucial role in facilitating intelligent advancements within this sector while transforming customer needs towards comprehensive solutions encompassing both products and services – a shift from traditional approaches towards online one-stop solutions explicitly tailored to Chinese consumers’ unique requirements.

Some Favorable Mom and Baby Products in China

Baby Food

Infant milk powder has historically served as the cornerstone of the maternal and infant products market, but it has entered a phase of intensified competition with diminishing volumes. Recent data indicate a decline in sales volume, overall sales figures, and average selling prices of infant milk powder during November and December last year. Therefore, all milk powder brands, domestic and overseas, are actively seeking new avenues for growth. Three potential areas that present more significant opportunities include baby hypoallergenic food, children’s powder, and family nutrition.

Regarding complementary food, this segment has essentially reached its saturation point. From 2020 to the first quarter of this year, online growth in complementary food gradually plateaued while baby snack consumption continued to rise. In this new stage of development within the complementary food sector, three key aspects will be tested: strengthening supply chain capabilities to ensure consistent production and delivery of high-quality products; achieving significant profitability on a large scale – this remains a focal point for many brands; deepening brand value as differentiation becomes crucial within the category.

To facilitate synergy between brands and channels, meeting user requirements across various nutritional aspects is essential, which includes continuously enhancing consumer experiences through changes in dosage forms and ensuring accurate intake measurements while also providing customized plans tailored to individual needs. In the long run, unwavering professionalism coupled with stringent standards will always serve as vital driving forces behind leading category innovations.

Diapers

The infant diaper market has experienced some degree of contraction in terms of industry scale. However, consumption polarization within this market remains evident. Although online diaper consumption has slightly declined, there is still a considerable growth rate of 19%.

Advancements in new materials, formulations, and cutting-edge technologies propel breakthroughs within the diaper industry. For instance, there is an increasing trend towards incorporating healthy and environmentally friendly plant-based materials into diaper products. Additionally, like baby skincare products, many diapers now feature innovative formulations that scientifically include moisturizing agents, soothing properties, and antibacterial components.

Technological advancement also plays a crucial role in product development. Diapers now utilize super absorbent cores with enhanced water absorption capabilities for better performance. Furthermore, patented designs contribute to improved functionality and user experience.

Clothing & Shoes

In the realm of baby clothing and shoes, product growth opportunities primarily revolve around functional upgrades and technological developments. For instance, outdoor goods designed for children require features such as quick-drying properties, sunscreen capabilities, or even self-heating functionality to cater to their specific needs in various seasons and environments. On the other hand, when it comes to children’s underwear, achieving characteristics like skin-friendliness, softness, and antibacterial properties becomes essential for users to recognize its value and be willing to invest in it.

By focusing on these aspects of functional enhancement and technological advancements within children’s clothing and shoe segments, both domestic and overseas brands can meet evolving Chinese consumer demands while ensuring optimal comfort, performance, and overall satisfaction. This approach not only addresses practical concerns but also aligns with parents’ desires for high-quality products that prioritize the well-being of their children.

Baby Skincare

The traditional baby skincare market has reached its saturation point in terms of growth. The conventional consumer habit of using a single product for the entire body and throughout childhood to adulthood no longer aligns with the preferences of young mothers and their babies. Over the past year or so, there has been a noticeable shift as many baby and child skincare brands have started repositioning their brands to differentiate themselves in the market. Currently, professional brands and specialized segments are emerging as the most competitive sectors within this industry.

This repositioning reflects an understanding that Chinese consumers now seek more targeted and specific solutions for their skincare needs at different infancy, childhood, and beyond stages. By catering to these evolving demands through differentiated branding strategies, domestic and overseas brands can better capture market share while meeting the unique requirements of today’s discerning mothers and babies.

Toys

The trend of IP-based, educational, and fun-oriented toys continues to prevail in the market. However, parents’ needs for entertaining and educating their children through toys have undergone some new changes. One notable change is the increased demand for children’s outdoor toys, which show a relatively high growth rate. These baby toys not only provide entertainment but also allow children to exercise their self-help abilities. Hence, such products have gained significant popularity.

Another prominent growth area lies in smart toys for children. As skills advance, these new playthings offer interactive and educational experiences that cater to the evolving needs of parents and children.

Maternity Products

The decrease in the number of pregnant women has resulted in a decline in overall consumption during pregnancy and childbirth. However, it is crucial for businesses catering to expectant mothers and babies to grasp the attention of this specific demographic continuously. While certain categories, such as mommy cosmetics, maternity wear and belly support bands, may be experiencing a decline, there is an increasing demand among new-generation mothers for maternity nutrition, scientifically designed breastfeeding products that offer comfort, and high-quality professional services post-childbirth. The concept of market concentration or “head effect” becomes increasingly prominent.

In today’s industry, weight loss and muscle gain have become essential considerations for maternal and child companies. However, subtractive strategies can often prove more challenging than additive ones. It requires companies to maintain focus on core areas while implementing targeted measures.

Future Trends of the Chinese Mom and Baby Market

Today’s young parents expect convenience and efficiency when it comes to purchasing for their kids. They desire a seamless experience, similar to ordering a take-out cup of milk tea. According to the data from Chinese eCommerce platforms, instant retail is expected to rapidly penetrate the mom and baby market in the coming years, with the market size projected to reach ¥100 billion. Baby formula powder holds a core value category position on real-time retail platforms, while diaper wipes, supplementary snacks, and other products demonstrate significant growth potential.

With the rise of eCommerce, the online consumption of maternal and infant products in China has experienced significant growth in today’s Internet age. This trend is driven by various factors, including the convenience and accessibility offered by online shopping platforms. The influence of Chinese social media platforms cannot be underestimated either; they play a crucial role in shaping consumer decisions within this market.

One notable aspect is the impact of KOLs(Key Opinion Leaders) and influencers who sway consumer preferences. These individuals have amassed large followings on social media, especially the top ones like Douyin(Chinese Tiktok) and RED(Xiaohongshu), where they share recommendations, reviews, and insights on mom and baby products. Their endorsements can considerably influence purchasing decisions as consumers trust their expertise and opinions.

Additionally, integrating these platforms throughout different stages of the maternal and infant market life cycle has led to increased traffic generation for related products. From pregnancy planning to newborn care and beyond, digital channels provide valuable information that helps parents make informed choices about specific mother and baby products.

The digitization brought about by the internet has also transformed traditional business methods within China’s maternal and infant retail sector. Consumers have become more digitally savvy, utilizing online resources to research product options before purchasing. Simultaneously, domestic and overseas brands are optimizing their channel operations digitally to improve overall efficiency within this industry.

This change towards digitization allows for streamlined processes such as online ordering systems, personalized consumer experiences through data analysis, and targeted marketing campaigns based on consumer behavior patterns – all contributing to an enhanced shopping experience for Chinese moms seeking quality products for themselves and their babies.

As we look into future trends within the Chinese mom-and-baby market, it’s evident that technology will play a pivotal role in shaping how consumers engage with brands while driving innovation across various aspects of this industry.

Don't Hesitate to Contact Us

Embark on a profound exploration of the unprecedented opportunities that lie ahead for overseas mom and baby brands in China’s thriving eCommerce market. With an authoritative voice, we delve into the intricate dynamics of this landscape to provide you with expert insights and strategic guidance. Our mission is to equip you with the knowledge required to navigate this terrain with utmost precision and unlock unparalleled success. Join us on this enlightening journey as we unravel the boundless potential that awaits your esteemed brand in China’s burgeoning market for mom and baby products.