Plans for China CBEC

International eCommerce, or selling across a border using an online marketplace, as opposed to domestic eCommerce transactions, is referred to as “Cross-Border eCommerce” (CBEC). Here, SENCENT will introduce four CBEC options that are available.

Plans for China CBEC

B2C (Business to Customer)

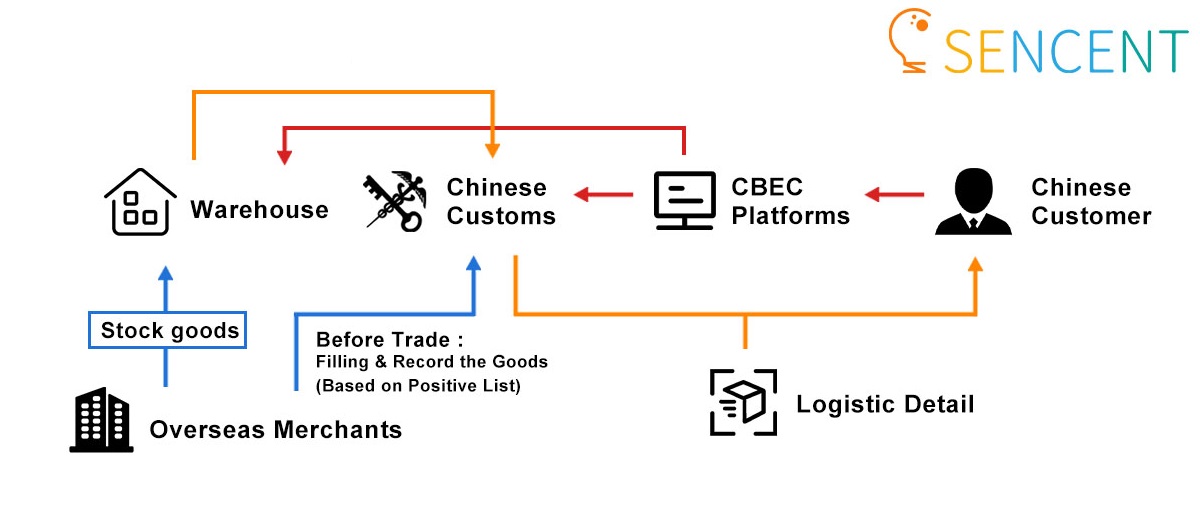

Direct Shipping Imports

B2C direct shipping imports are the second dedicated method for eCommerce shipping that the Chinese government has been promoting since 2014.

It only takes 24 hours to clear customs, and the whole transit time is compressed to 5-12 days. Some logistic service providers will manage the customs tax on behalf of the retailers, and the packages will be combined with bulky products and freight routed to a China-bonded area for quick customs processing.

In addition, the retailers’ online stores or selling platforms must support Chinese payment options like Alipay and WeChat Pay because China customs demand this information to verify the worth of the items.

There are no upfront shipping fees unless an order is placed because the goods are kept in the merchants’ overseas warehouse. This provides retailers with great inventory flexibility and is frequently employed in the early stages of CBEC selling to China.

Lastly, it is commonly utilised by somewhat expensive commodities with fewer orders. The majority of our partners widely use this approach. It can lower most of the risks for the merchant.

BC | Direct Shipping Mode

1. Order placement + Payment (via 3rd-party payment platform) + Provide Delivery Address

2. Sharing order, payment, and logistics details

3. Notification for goods dispatching

4. International logistics & Last-mile Delivery & Arrival

B2B2C (Business to Business to Customer)

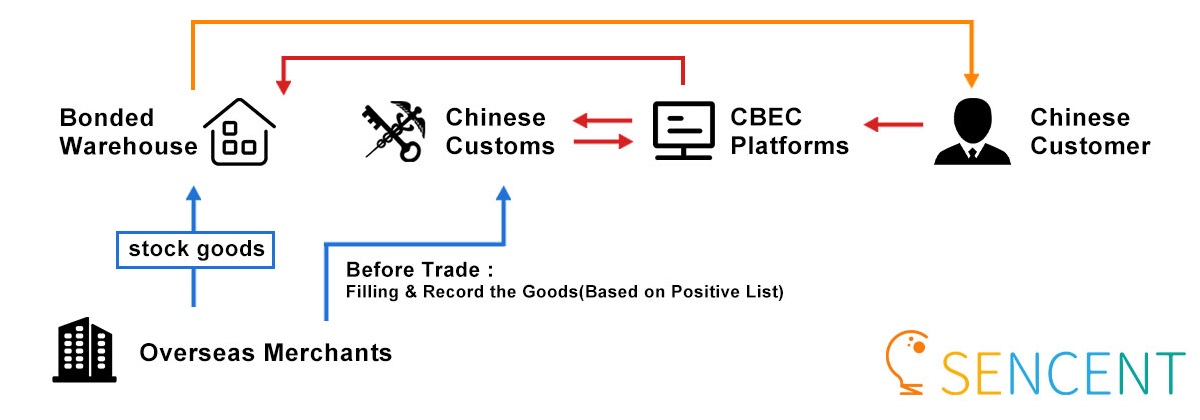

Bonded Warehouse Imports

Regarding logistics, bonded warehousing (B2B2C or BBC) is a more suitable choice when selling goods through CBEC to China. In China, dutiable commodities may be housed in a building or other secure facility within a specific customs surveillance area without having to pay duty to them. Thus, ordered goods typically reach the customer’s home quickly, offering the best purchasing experience to the customer.

BBC | Bonded Warehouse Mode

1. Order placement + Payment (via 3rd-party payment platform)

2. Sharing order, payment, and logistics details

3. Agree to dispatch & Send out a Notification

4. Last-mile Delivery & Arrival

eCommerce Retail lmportation Tax Rules

The single transaction limit for CBEC imports is ¥5,000.

The annual individual transaction limit is ¥26,000.

For CBEC imports within the limit value, the tariff rate is temporarily set at 0%.

VAT and GST exemptions for imports will be abolished and levied temporarily at 70% of the statutory tax payable.

CBEC Composite tax rate= (GST + VAT)/(1-GST)×70%

Tax Fee = Product Unit Price × PCS × CBEC Composite Tax Rate

C2C (Consumer to Consumer)

Personal Express

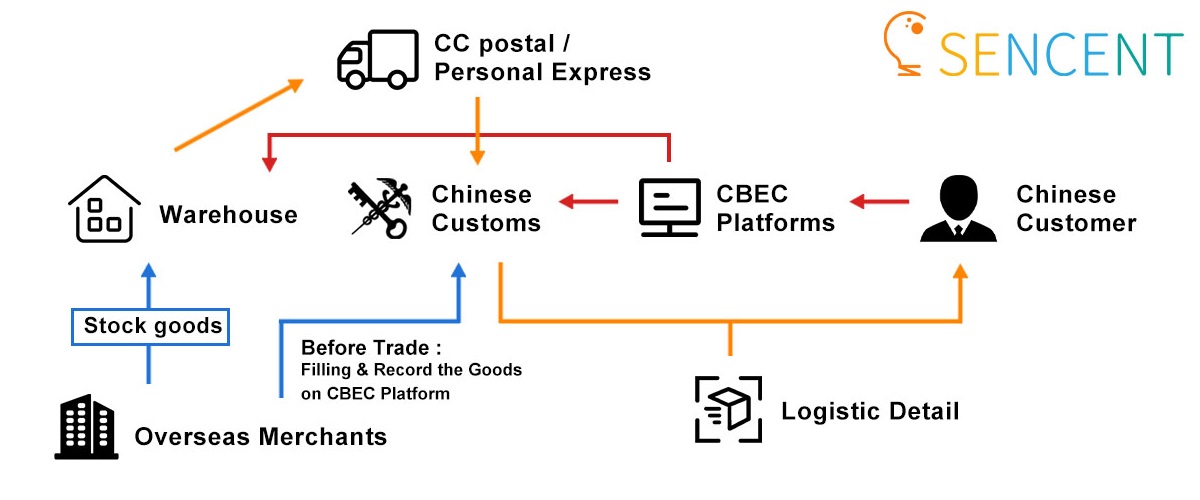

The most traditional way for China CBEC is C2C personal express (Consumer to Consumer).

This is the most traditional way and has existed in China for over 20 years. It’s set for personal use at first and enjoys some tax-free policies. Nowadays, it’s mainly used for trade between two individuals (e.g., non-certificated purchasing agents) because of saving taxes. The value of the contents of a parcel cannot exceed ¥1000 unless it solely contains one item that cannot be separated (e.g., a t-shirt or a pair of shoes). The personal postal articles tax will be applied using this approach (please read Personal Postal Articles Tax), and the tax will be waived at a tax value of less than ¥50.

CC | Direct Mailing Mode

1. Order placement + Payment (via 3rd-party payment platform)

2. Sharing order, payment, and logistics details

3. Notification for goods dispatching

4. International logistics & Last-mile Delivery & Arrival

C2C (Consumer to Consumer)

Postal

In this method, China Post, which since 2019 has amalgamated with the well-known EMS service but continues to operate solely under the China Post moniker, clears the products via customs. Since approval will be based on the description and value listed on the postal label, there is no need for a data interface. Products may not be taxed because the customs inspection will only be conducted on sample size.

But the customs system has lately been incorporated into a national system, providing a comprehensive database for tighter controls on mail-order items. Besides, the following personal express and direct purchase import options were introduced. The volume of postal parcels has drastically decreased. Few people want to take a risk to face the tax penalty.

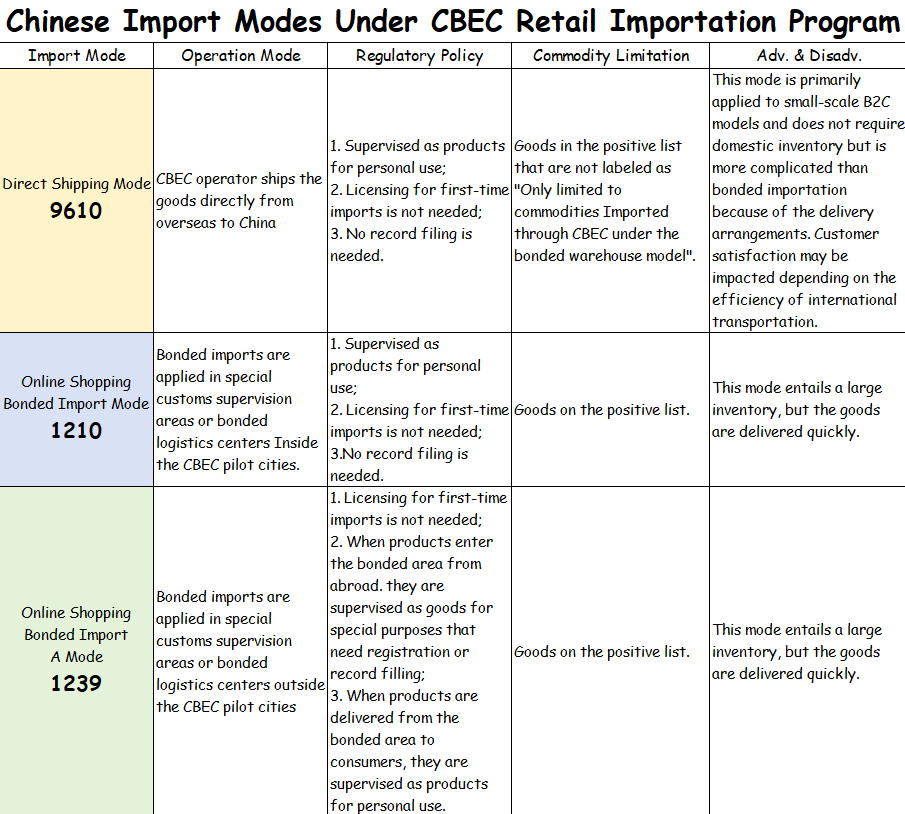

Differences between 3 Modes

Summary

Every business should be profitable. For various products, businesses need to consider different import methods to benefit from tax reduction plans. Companies should be aware that their export methods can change significantly over time.