Historically, ice cream has always been loved by the Chinese. About 3,000 years ago, wealthy families in China started serving crushed ice and fruit juice to their guests. During the Tang Dynasty, some merchants specialized in selling popsicles at a high price in those heating days of summer. However, ice cream has never been as popular among all levels of China society as it is today.

With the continuous improvement of the national economic level and the enhancement of consumption ability, Chinese consumers’ willingness to purchase snack food continues to rise. The market size of China’s ice cream industry is expanding year by year, and we can foresee a bright future for the Chinese ice cream market.

In this article, we will have a comprehensive analysis of the Chinese ice cream market, which can help you understand the Chinese ice cream market in detail, and further, lead your brand to enter the Chinese market smoothly.

Overview of the Chinese Ice Cream Market

Market Size

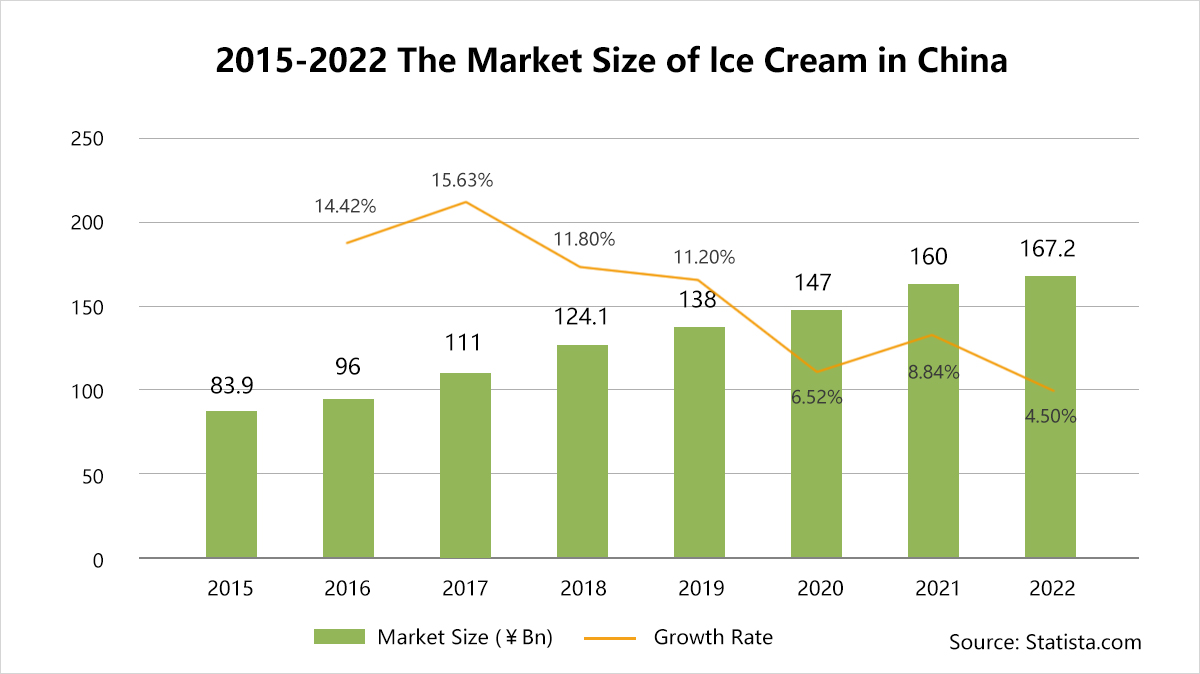

Since 2015, with the rapid development of China’s food industry and the improvement of people’s living standards, the market size of the Chinese ice cream industry has also increased yearly. According to Statista, the market size of the Chinese ice cream industry in 2021 already reached ¥160 bn, which has doubled compared with 2015, and at the same time, increased by 8.84% year-on-year in 2020 (the growth rate in 2020 was slowed down due to the impact of the COVID). In 2022, the market size even reached ¥167.2 bn.

Market Share Distribution

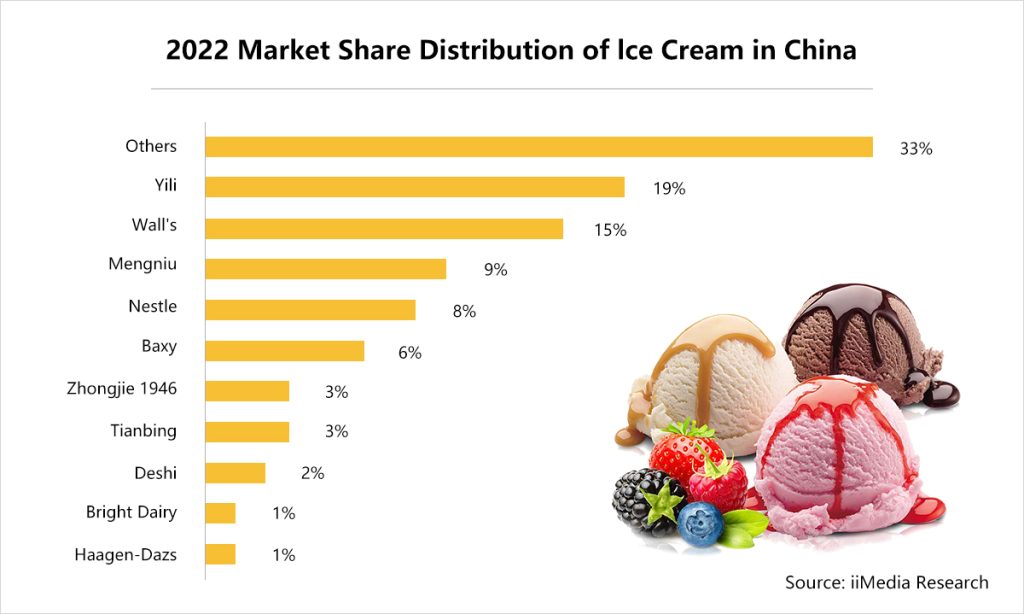

From the perspective of corporate competition, Yili(伊利), Wall’s, Mengniu(蒙牛), and Nestlé are currently in the leading positions in the Chinese ice cream market. The offline market shares reached 19%, 15%, 9% and 8%, respectively. In addition, Deshi(德氏), Hongbaolai(宏宝莱), Tianqi(天淇), and other enterprises have formed strong regional brands by taking advantage of their respective location.

Off & Online Ice Cream Market Ratio

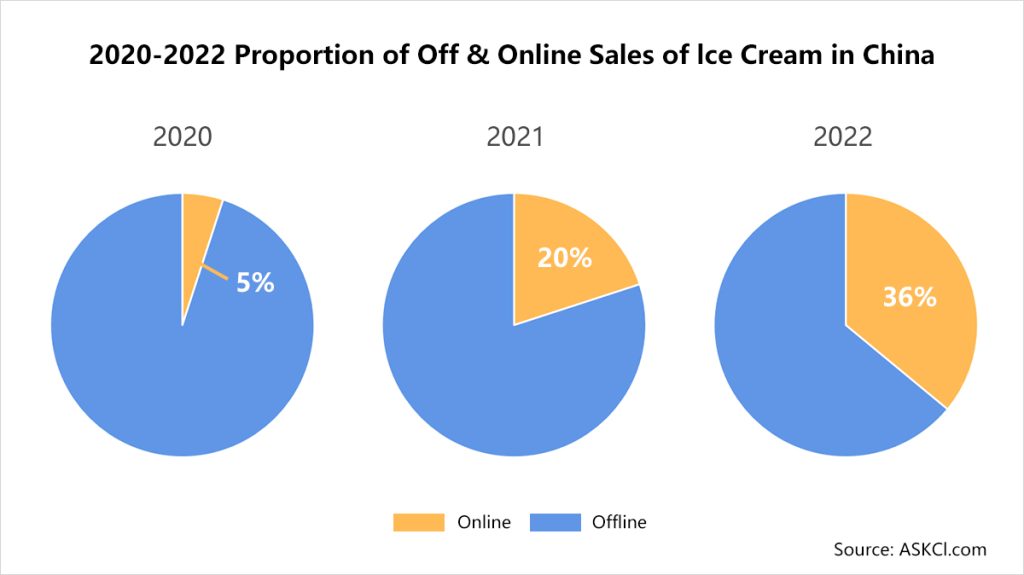

In 2020, online sales of ice cream accounted for about 5%, and by 2021, this proportion has risen to 20%, as the data from ASKCI tells us. And in 2022, the proportion of ice cream products sold through online supermarkets or comprehensive e-commerce platforms has reached a new height of 36%.

Although limited by the product characteristics of the ice cream itself, under the environment of continuous development of transportation technology and transportation speed, we can confidently predict that the proportion of online sales in the ice cream industry will keep increasing.

Time to Get Familiar with the Chinese Ice Cream Consumers

The previous part of the article aimed to tell you that the Chinese ice cream market is pretty promising. So, once your brand enters the Chinese market, in order to operate your brand nicely and gain consumer loyalty in China, you are for sure need to learn more.

Following are the tips we have prepared for you.

What is the Most Acceptable Unit Price Range for Chinese Ice Cream Consumers?

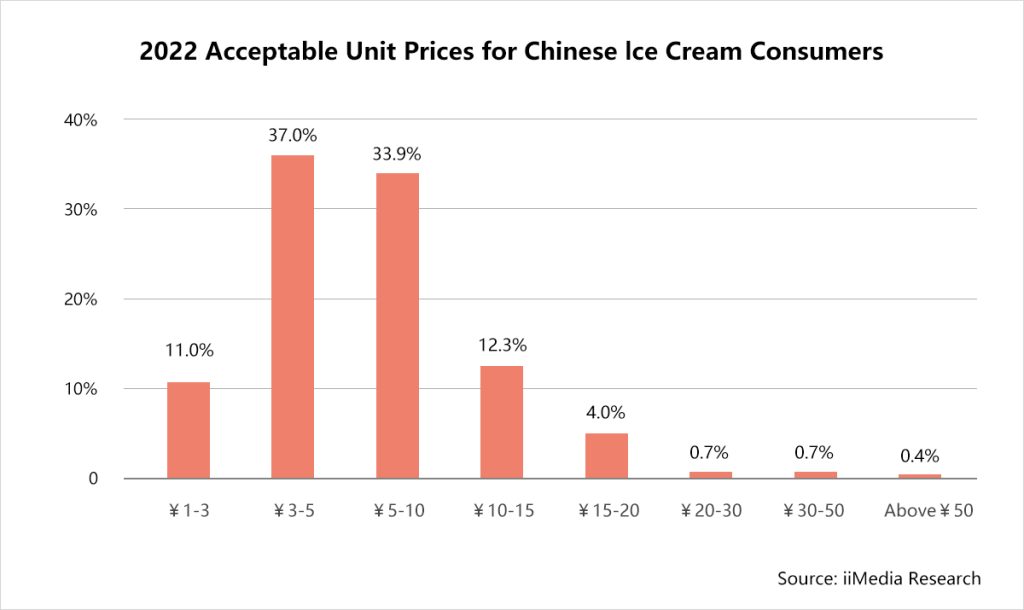

According to iiMedia Research, the acceptance of Chinese consumers for the unit price of ice cream is generally between ¥3-10, accounting for 70.9%, and 12.3% of consumers can accept ¥10-15. Meanwhile, the acceptance of ice cream with a unit price of more than ¥20 is shallow.

We can confidently tell you that it is difficult to find ice cream below ¥3 in the Chinese market today, and the unit price of ¥3-10 has become the norm.

Higher prices mean more profits, and distribution channels can also have more significant profit margins. Supermarkets and convenience stores that are more willing to sell high-priced ice cream are more likely to become gathering places for “Ice Cream Assassins” (the phrase describes the feeling of consumers in China who pick an ice cream from a freezer, expecting to pay a few yuan to get cool from the intense heat, but were only to be taken by surprise by the exorbitant price when they come to pay).

Are Chinese Consumers Really Like Ice Cream?

According to survey data, 98.9% of Chinese consumers like to eat ice cream. Among them, consumers who eat ice cream more frequently in summer account for the majority, with 27.3% and 37.8% of consumers eating ice cream once a day and once every 2-3 days, respectively.

Ice cream used to be a seasonal snack, Summer (starting from June to August) is definitely the peak season for ice cream sales. But still, 73.2% of Chinese consumers will buy ice cream even in winter, and 39% of consumers will buy ice cream all year round. In this case, we can tell that the seasonality of cold drinks and snacks is gradually weakening, and various ice cream flavors emerging on the market continue to attract consumers’ attention and taste buds. Most consumers are really interested in eating ice cream whether for relaxation or nostalgia.

Chinese Ice Cream Consumers’ Image

Regarding gender, women are the main force of ice cream consumption, accounting for 62.8%, and men account for 37.2%. From the age group perspective, young adults aged 18-29 and 30-39 are the leading groups, both accounting for more than 40%.

So, we can say that ice cream is quite popular among the younger generations, especially office ladies who are busy working. These people have high purchasing power and willingness. And with the rapid development of society, the pace of life and work has been dramatically accelerated, causing social pressure naturally increases. Therefore, more and more consumers associate ice cream with comfort, relaxation and stress, hoping to be soothed and healed.

Driven by the rising demand, the ice cream market in China and even the world has shown a gratifying trend of rising. The need for ice cream products represented by quality life and the pursuit of pleasure can be gathered through e-commerce, and it is easier to form a specific market size.

Consumer’s Consideration Before Purchase

As a kind of frozen food or snack, ice cream is loved by consumers. It is a product that perfectly combines elements such as sugar, fat, chilled water and air to create a mouthwatering concoction. In recent years, ice cream has been changed from a traditional heat-relieving frozen snack into a food with rich raw materials, diverse tastes, the pursuit of health, pleasure and a high-quality lifestyle.

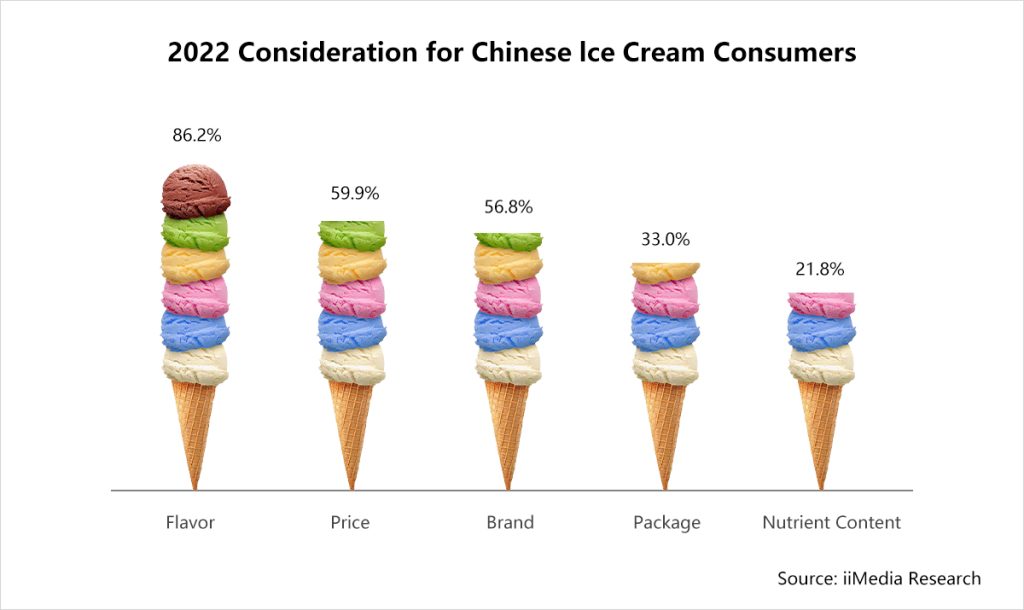

So, for Chinese consumers, the flavor is the primary factor considered by Chinese consumers when buying ice cream, accounting for 86.2%. Followed by price and brand, the proportion is close, respectively 59.9% and 56.8%.

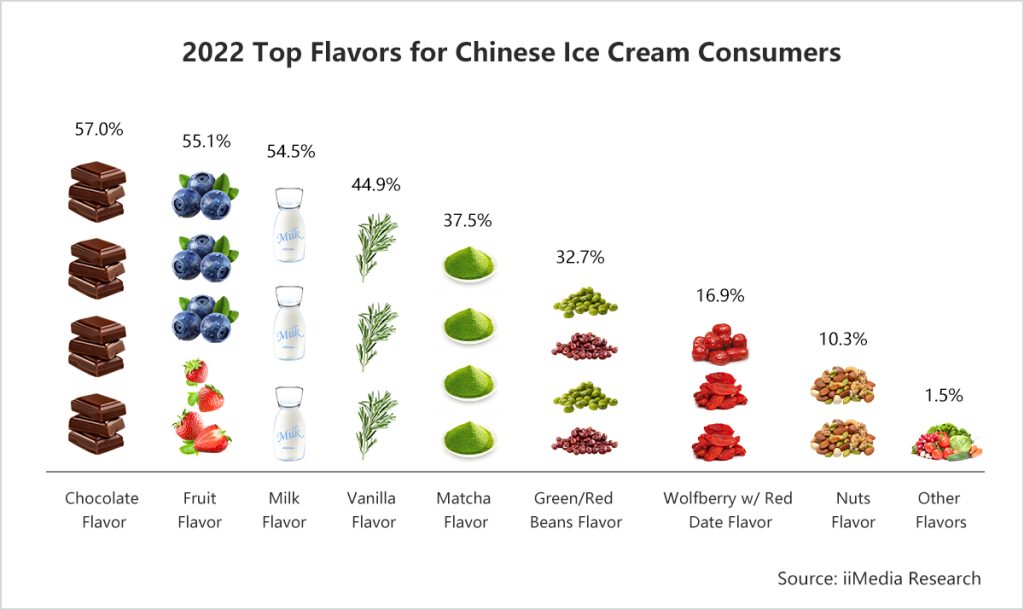

Talking about flavor, chocolate, fruit, and milk flavors are the most popular ice cream flavors among Chinese consumers, all of which are favored by more than 50% of consumers.

Although new ice cream flavors have emerged in an endless stream in recent years, the tastes that consumers love follow the habits of the past. While ice cream brands are “toe in the water” for the flavors of new products, you must also consider the tastes of the public.

Chinese Consumers Welcome Healthier Ice Cream

Under the background that Chinese consumers pay more attention to spiritual needs, healthier lifestyles and following the “Dual-Carbon” strategy that China started promoting recently, the development of the Chinese ice cream industry in the future will definitely show completely different characteristics from the past. Product, technological and cultural innovation will become the future ice cream Industry enterprises need to focus on the complex problems to overcome.

Nearly 80% of consumers said they are willing to buy sugar-free ice cream. Chinese consumers also favor low-fat, low-calorie, and low-sugar ice cream products. Driven by healthy consumption, more healthy and functional ingredients in ice cream have yet to be discovered. How to balance delicacy, health and nutrition is the direction that future ice cream industry entrants need to consider.

With the renewal of the new generation of consumer groups, young people will pay more attention to the role of food in carrying emotional needs, satisfying social needs and reflecting on cultural pursuits. In the future, the ice cream industry will pay more attention to cultural innovation to fulfil the spirit of the new generation of consumers’ needs.

Nowadays Chinese E-Commerce &

Why Choose to Sale via Cross-Border E-Commerce Platforms

As we have mentioned in the previous part of this article, the online market of ice cream in China has increased dramatically within a few years time. Actually, in today’s world, the whole e-commerce industry is gradually growing worldwide. As time passes, new e-commerce markets engage, and existing markets are approaching new milestones. We are confident that e-commerce is a global phenomenon, and the growing rate of it in almost every country is very healthy.

Along those markets, China is the world’s biggest e-commerce market, with an annual growth rate of 21%. At the same time is one of the fastest-growing e-commerce markets, contributing $2.78 trillion in annual online sales, which occupied 52% of the world’s total retail sales in 2022.

Within a few years, we have seen the development of e-commerce platforms. The entire e-commerce industry has developed from traditional e-commerce to the current live e-commerce, with 93.2% of netizens being heavy users of short video platforms (e.g. Douyin/Chinese Tiktok).

The content that can be seen on the short video platform is quite rich. Diversified and healthy content can meet the multi-level needs of users, and at the same time, retain users. The explosive power of live e-commerce and short video platforms lies in the length of time users use them. The average duration of the short video platform users in China is 129 minutes, with an average daily usage frequency of 15 times. The users’ daily activity is 363 million, and for monthly is 662 million.

How to find accurate users on the short video platform for vertical benchmarking is the key for brands(both domestic and overseas) to win in this competitive short video platform “arena”. The users of the short video platform are sticky, and whoever seizes the users’ usage time has a higher probability of making them place orders. The overall trend in the future is to accelerate the pace of development of the short video platform industry.

Cooperate with a Chinese E-Commerce-Focused Platform is the Key to Achieving your Goal

After reading the articles above, you must know that SENCENT is always ready to help your brands enter the dynamic and vast China e-commerce market. Our company has a professional team with good enough experience and practical success cases to answer all kinds of questions you encounter while exploring the market of China.

For more questions about collaborating or want to learn more about the Chinese Ice Cream Market, Snacks Market, or even the whole Chinese E-commerce Market, please feel free to Contact Us!