With the arrival of summer in China, the temperature rises and the UV index increases, making the Chinese people increasingly aware of the impact of excessive sun exposure on skin health and aging.

“Sun protection is anti-aging.”

The popularization of this concept has led the sun protection industry to usher in a peak season for consumption.

At the same time, diversified needs such as multi-functional and personalized sunscreen are also driving the rapid development and changes in the sunscreen market. Chinese consumers pay more and more attention to the quality and effect of products, and require sunscreen products not only to have sunscreen function, but also to meet the needs of hydration, whitening, and anti-oxidation. Therefore, the research and development of sunscreen products are becoming progressively crucial, and innovative designs and unique features can make brands more competitive in the future Chinese E-Commerce market.

Sunscreen Market in China

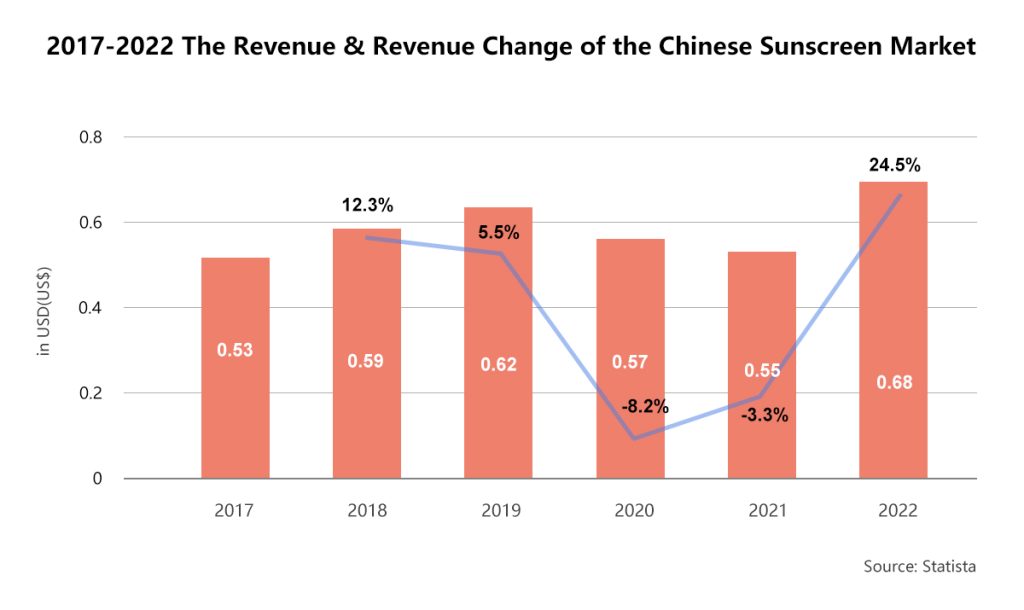

According to Statista, the revenue of the Sun Protection segment in 2022 has almost reached a billion dollars, with a 24.5% rising compared to 2021(due to the impact of the COVID-19 pandemic, negative growth happened in the year 2020&2021).

Sun protection products can be separated into two parts, “hard” protection refers to physical sunscreens, including umbrellas, hats, sunscreen clothing, etc. “Soft” protection refers to applying sun creams, sunscreen sprays, and other products to reflect or absorb ultraviolet rays to achieve sunscreen’s effect. The average monthly sales of “hard” products accounted for 71%, and the transaction volume was ¥1.246 B, accounting for 63%. Those “soft” products accounted for 29%, with a transaction volume of ¥718 M, accounting for 37%.

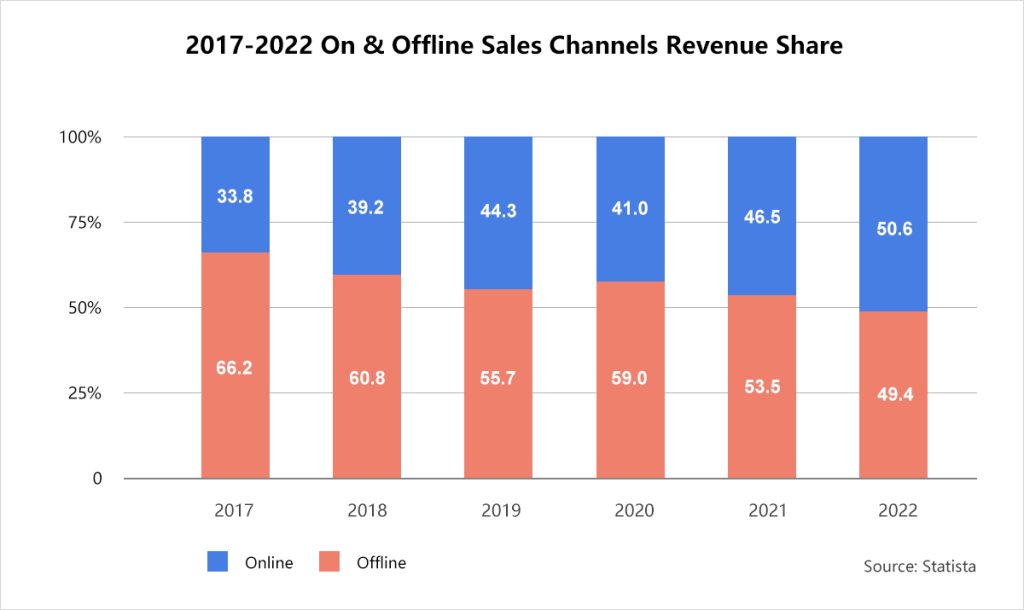

For the online & offline markets, the latter occupied 66.2% of the total market in 2017. However, the online market has grown to a brand-new level, accounting for 50.6% of the whole sunscreen market, making it became a 50-50 situation in 2022.

Features of the Chinese Sunscreen Consumers

Consumer Distributions & Images

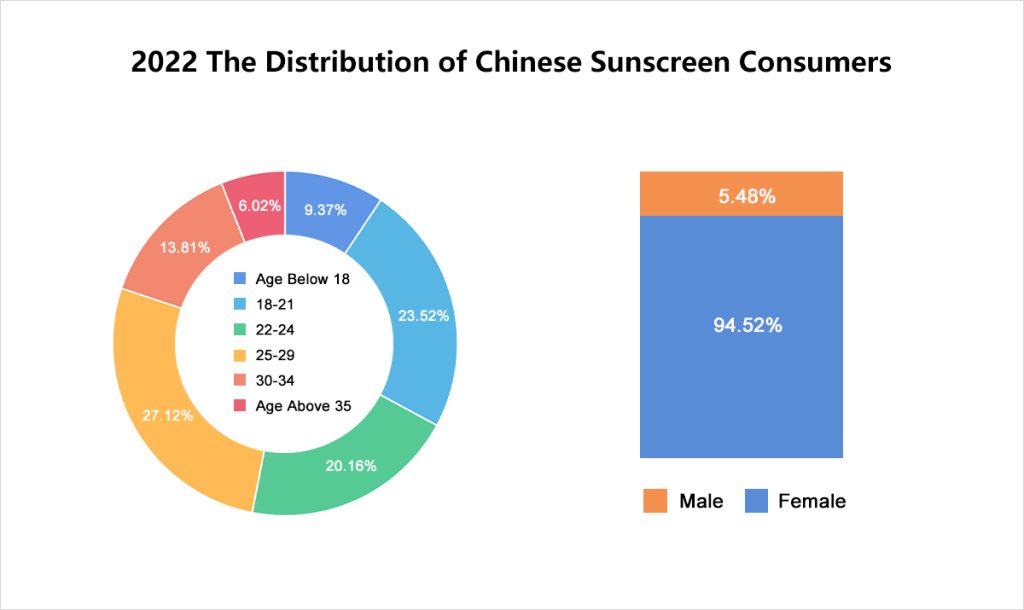

Female dominates the groups of consumers of sunscreen products, but the proportion of male consumers is gradually increasing, especially for those aged between 18-21, who have increased demand and attention to sunscreen products.

As an elite force in the sunscreen product market, female consumers pay more attention to skin health, sunscreen and cost-effectiveness, and their primary needs are concentrated on outdoor activities and vacation travel. Young women are the major consumers, paying attention to daily skin care, outdoor activities and other occasions.

A particular group of consumers that sunscreen brands should heed is children and pregnant women, whose demand for sun protection has increased rapidly. In detail, infants and young children need sunscreen products that do no damage to the skin, and are convenient to smear and remove; pregnant women pay more attention to the product’s tactility and protection effect.

Sunscreen Products Price Ranges

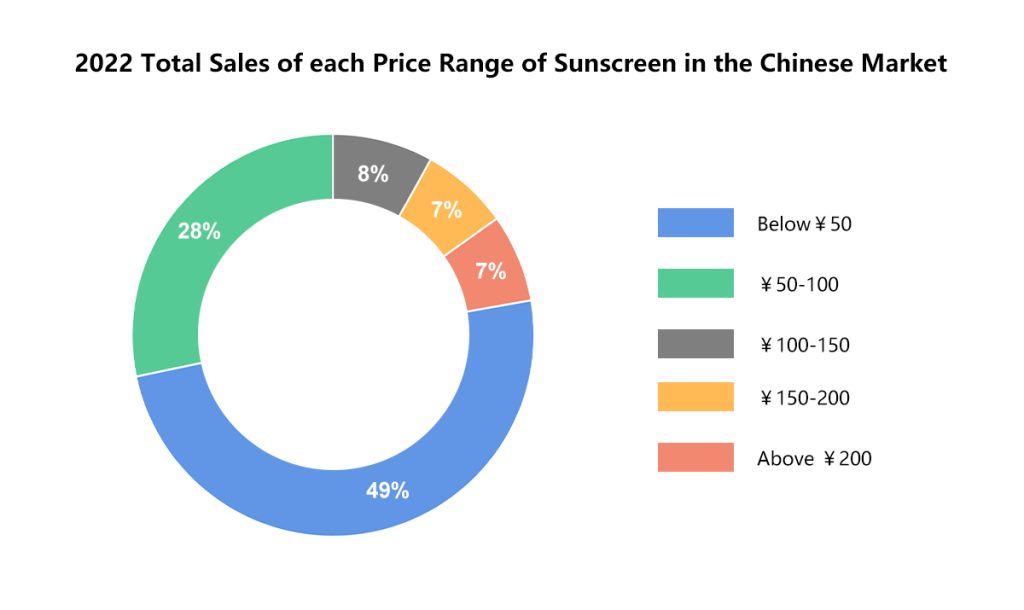

In the Chinese market, the price ranges of sunscreen products are widely distributed, including 3 ranges: economical, mid-range, and high-end. Among them, the economical sunscreen products are generally below ¥50, the mid-range is between ¥50-200, and the high-end is, of course, above ¥200.

Judging from the total sales of each price range, economical sunscreen products are relatively affordable and suitable for mass consumer groups, accounting for 49% of sales, followed by products between ¥50-100, accounting for 28% of sales. In addition, the price of higher-end sunscreen products also has room for development, with sales of products priced at ¥150-200 and above ¥200 both accounting for 7%.

Sunscreen Product Types & Seasonal Features

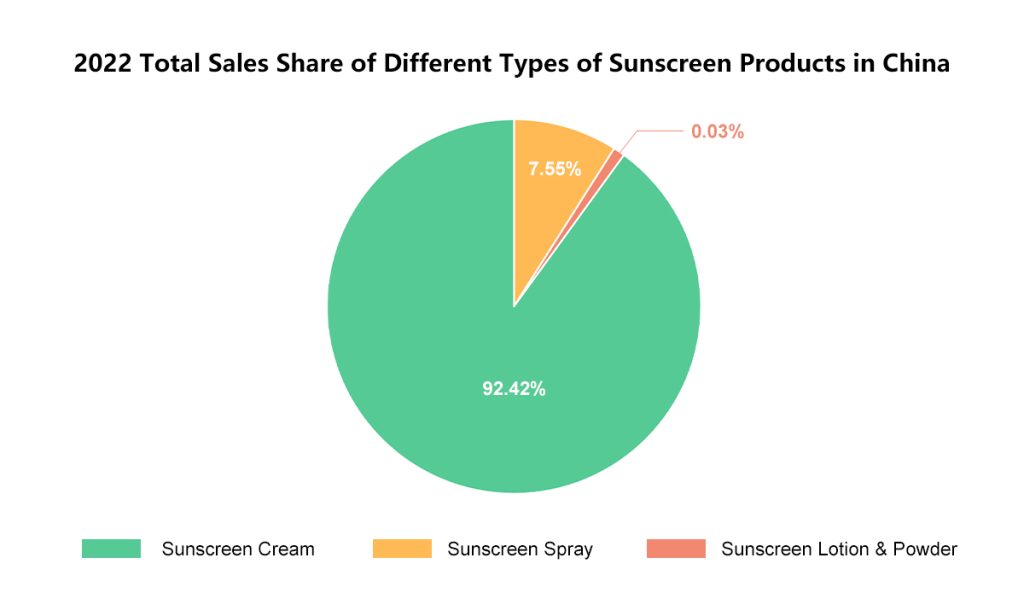

In the Chinese market, new sunscreen products are emerging one after another. In addition to sunscreen cream, many other types of sunscreen products have hit the shelf in recent years, such as sunscreen sprays, lotions and powder. Based on traditional sunscreen’s stability, portability and safety, it is still the first choice of Chinese consumers. In 2022, the total sales of sunscreen cream accounted for 92.42% of the whole sunscreen market on the Chinese E-Commerce platforms, far exceeding other categories. Nevertheless, some consumers choose to buy sunscreen spray because they need to quickly achieve the effect of sun protection in outdoor high-intensity sunlight environments.

Chinese consumers are forward-looking in purchasing sunscreen products. In the early days of Spring, there is a clear peak in sales of sunscreen products, which usually start to increase in February. From May to August is the best-selling period for sunscreens, and then enters a period of decline and flat sales. However, as Chinese people have paid more attention to skin protection in recent years, the sales of sunscreen products in autumn and winter have also increased.

The seasonal influence factors of the sunscreen are pretty significant. Since the current sales growth period of the sunscreen is in the first half of the year, and because Chinese consumer habits are forward, both domestic and overseas brands should lay out the sunscreen market in advance, for the sake of seizing the business opportunity, amplifying the marketing volume, and promoting higher transaction conversion when the sunscreen products enter the hot sales period.

Sunscreens & China E-Commerce

In today’s world, China is the biggest e-commerce market, with an annual growth rate of 21%. At the same time is one of the fastest-growing e-commerce markets, contributing $2.78 T in annual online sales, which occupied 52% of the world’s total retail sales in 2022.

As the Chinese e-commerce market grows, more options are showing up for overseas brands and retailers trying to enter, and the best export method for the present is to use the Chinese Cross-Border E-Commerce platforms as a powerful tool.

As the population in China grows and the Chinese consumers’ willingness to live a healthy life, sunscreen is expected to continue to gain strength, especially if domestics and overseas brands continue to invest in localized new product design, improvement, and further marketing.

Sunscreens & Chinese Tiktok

Brief Market Overview

According to the official data collected by Douyin(aka. Chinese Tiktok, the No.1 short video platform in China and also one of the best e-commerce platforms), compared to 2021, the GMV of the sunscreen market on the Douyin platform in 2022 has increased by 113.3%, the total sales of promotion goods gain a 68% growth, and the number of people who made purchases has doubled(+105%). Moreover, the search rate of “sunscreen-related” keywords or topics rose sharply on the platform, up to an astonishing percentage of 278%.

What Caused the Demand?

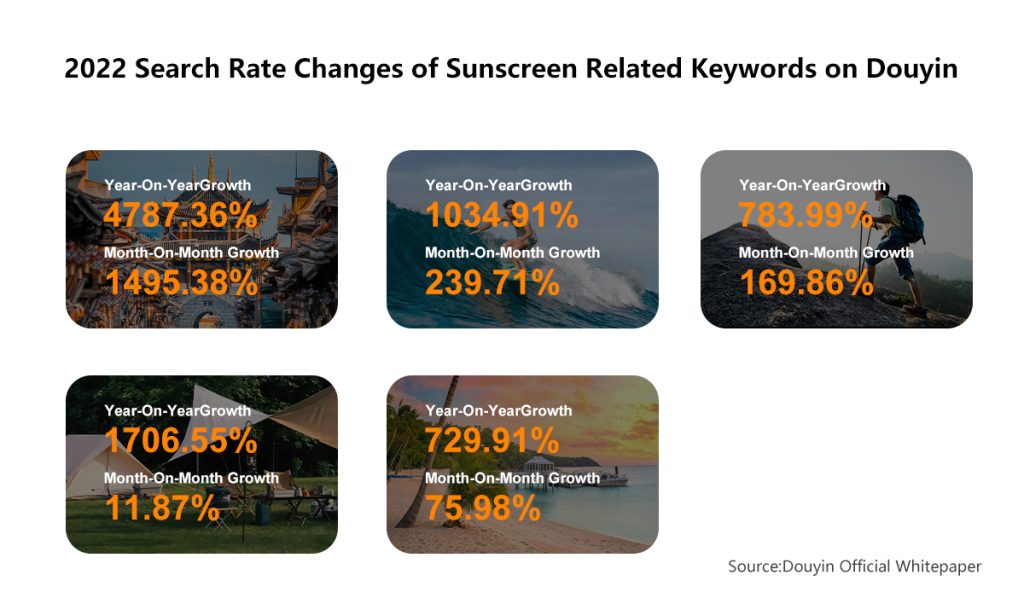

Starting from December 2022, at the time that the government canceled the lockdown because the COVID-19 pandemic ended, Chinese people’s willingness to go outside and get some fresh air has dramatically heightened. So, for both month-on-month and year-on-year statistical results, the search rate of the keywords like traveling, mountaineering, surfing, camping, sand beach etc., increased significantly.

Not Just About Sun Protection

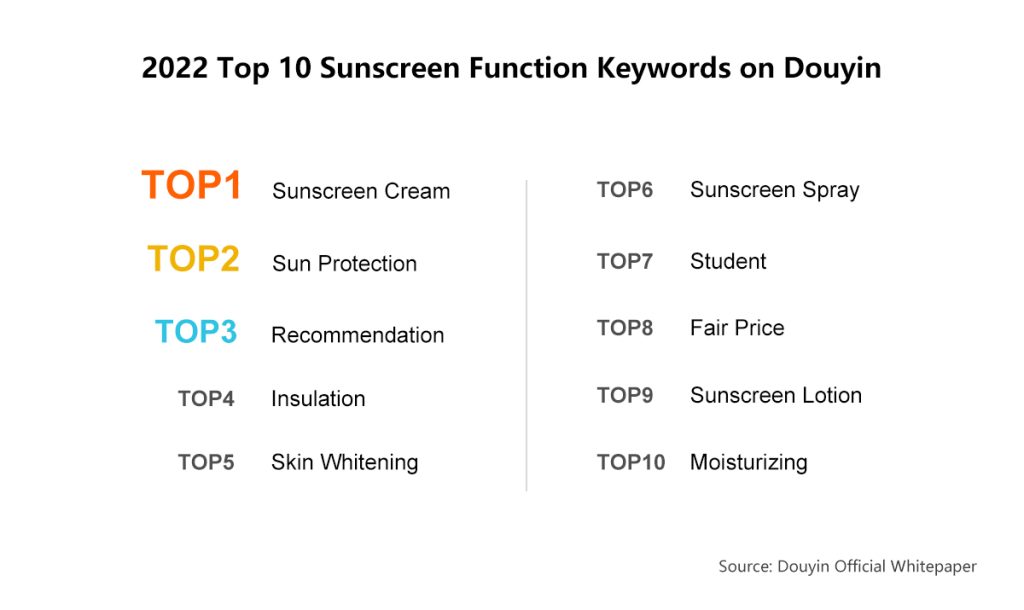

When Chinese consumers buy sunscreens, they mainly pay attention to the sun protection effect, smell, ease of use, ingredient safety, and also, brand awareness and reputation. Meanwhile, Chinese consumers focus on the cost performance of products. Sunscreen brands can carry out precise positioning and marketing strategies according to the differences in gender, age, and consumer concerns.

As Chinese consumers note the efficacy of sunscreen products, in addition to the basic anti-UVA and UVB, many brands have begun to add multiple functions to sunscreen products, such as skin nourishment, moisturizing, soothing, whitening, and heat insulation, etc., which bring new opportunities and benefits to the Chinese sunscreen market.

These days, multi-functional sunscreen products are in great demand in the Chinese market. With the prevalence of plain and convenient makeup, the need for primer products with sun protection effects is expanding, and the competition is gradually intensifying. Currently, the leading extended effects of sun protection include moisturizing, whitening, pores hiding, anti-oxidation and other multiple functions.

With the continuous expansion and rapid development of the sunscreen consumer market, the brand’s concept upgrade of sunscreen is not limited to applying it on the skin. The demand for sunscreen on lips, hair, and other parts of the human body in the market segments is also growing, and will definitely become a new direction in the vertical field.

To Promote Sunscreen Products, You Should Know...

In the interest of expanding brand influence, domestic and overseas brands should start marketing on Chinese E-Commerce platforms. Celebrity endorsements, hit product promotions, and KOL marketing has become widely recognized marketing methods. Successful marketing can expand brand awareness, build brand reputation, and eventually increase sales. For overseas sunscreen brands, your product’s sun protection effect is what Chinese consumers consider the most, and it is also the foundation for the survival of sunscreen brands. Based on emphasizing marketing, brands need to increase investment in research and development, and regard quality as the cornerstone of brand development.

Don't Hesitate to Get in Touch with Us!

We, SENCENT, have in-depth cooperation with Douyin Cross-Border Store. And suppose you want to get more information, well, in that case, we strongly recommend you read our previous article about Douyin E-Commerce to understand comprehensively. For further communication or things about collaboration, please feel free to Contact Us!